David Rymer has his suspicions about which of his fellow seniors are squirrelling away cash to avoid having their pensions cut. They're the ones whose holidays seem just a bit too fancy or frequent.

Subscribe now for unlimited access.

$0/

(min cost $0)

or signup to continue reading

But while former Reserve Bank official Peter Mair has claimed many pensioners are committing ''enormous'' fraud through holding undeclared cash stores, Canberra Seniors Centre president Mr Rymer was bemused by the allegation of widespread rorting.''I certainly know of people who get benefits because they've stashed it away … you know from talking to people, you read between the lines, you hear about their holidays,'' Mr Rymer said.

''But I don't think it's widespread. A few might do it but we're all getting tarred with the same brush.''

Council of the Aging ACT executive director Paul Flint agreed a small minority of pensioners were sitting on large cash assets to avoid being hit by means testing. He said he always advised people against it, in part because it put them at risk, and not just from authorities who might learn of the undeclared assets. ''It's not a very good strategy, it increases your risks of falling victim to crime if you're keeping or carrying money around and people find out about it,'' Mr Flint said.

While seniors were willing to concede some of their generation were hoarders, many felt under attack for a legitimate preference for using cash. Some, Mr Rymer said, didn't believe it was fair to pay bank fees all the time, so preferred to manage their money the old fashioned way. Others didn't trust, or didn't understand, modern banking.

The idea of a parent or grandparent leaving behind an armchair or a garden shed packed with notes might be the fantasy of some people. But Mr Rymer said times had changed, and the attitude of most seniors he knew was that their money was theirs to spend and not an inheritance to be protected. ''There's an attitude that young people are so well off now that you don't need to save money to hand down to your kids.''

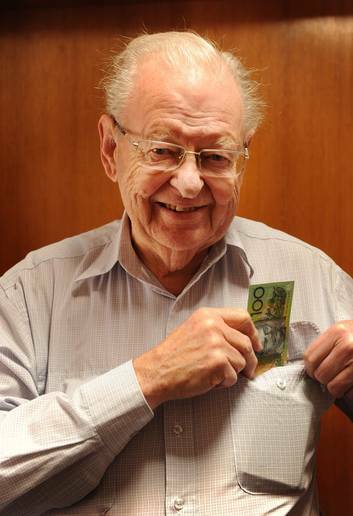

As is the case for most of us, yesterday was a rare occasion for Mr Rymer to handle a $100 note. He scoffed at Mr Mair's suggestion to the Reserve Bank that withdrawing $100 notes from circulation would stop them. ''They'll just start saving $50 notes and $20 notes. It won't stop the small number of people who are rorting, it'll just double the pile of money.''