Best Australian Forex Brokers

This is sponsored content for PropCompanies.

If you're an Australian forex trader searching for the ideal broker, look no further. We've sifted through data from over 40 brokers to present you with a list of the top 10 forex brokers specifically curated for traders in Australia.

- Eightcap - Best Australian Broker

- Pepperstone - Best for Automated Forex Trading

- IC Markets - Forex Broker with the Lowest Spreads

- eToro - Best Copy Trading Forex Broker

- Fusion Markets - Low Commission Forex Broker

- OANDA - Best Forex Broker for Beginner Traders

- IG - Australia's Largest Retail Forex Broker

- FP Markets - Best MetaTrader 4 Broker

- CMC Markets - Best for Forex and Share Trading

- Plus500 - Best Mobile Trading App

Who are the Best Forex Brokers in Australia?

Speaking from our collective experience as Australian traders we think there are a number of key features to look for in a broker. These features should include tight spreads, fast execution speeds, and access to top analytical and automation tools.

In this guide, we'll also be laying out the benefits and weaknesses of each ASIC-regulated broker we cover. This allows us to give you a balanced view to facilitate your decision when choosing a broker. Whether it's trading fees, spreads, or fast execution, you'll know what each broker excels in and where they may fall short.

1. Eightcap - Best Australian Forex Broker

Eightcap carves out its own lane with ultra-competitive spreads, the tried-and-true MetaTrader platforms, and a vast selection of CFDs.

Eightcap benefits

- Average spreads that outpace the market by 70%

- Access to MetaTrader 4 and MetaTrader 5 and TradingView Platforms

- A comprehensive range of CFD products featuring over 40 forex pairs and 87 cryptocurrencies

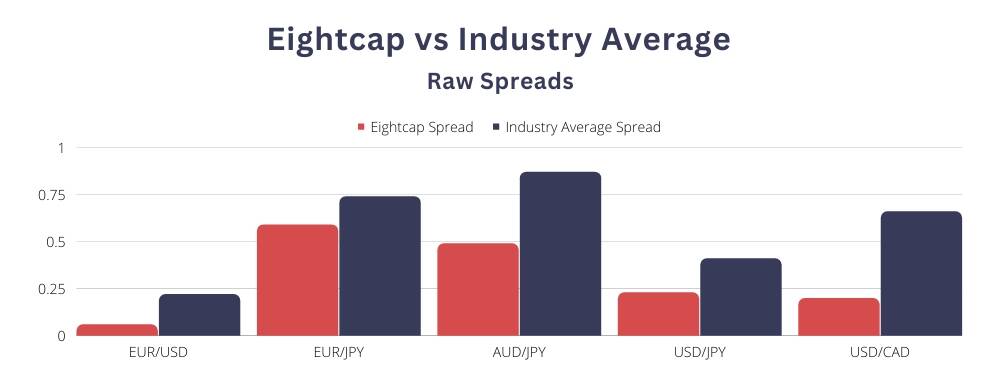

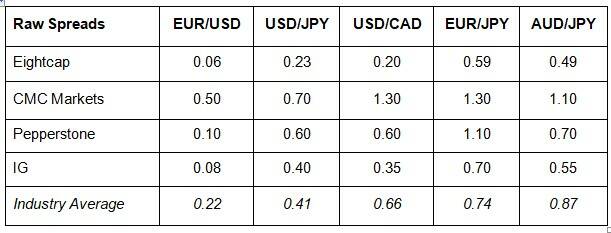

Eightcap's competitive low spreads

From our exhaustive research, after examining over 40 brokers, Eightcap's Raw Account stands out as a frontrunner if you are after tight spreads.

Whether your focus is on the Euro vs US Dollar (EUR/USD) or the Australian Dollar vs Japanese Yen (AUD/JPY), Eightcap spreads beat the competition. On average, you will find its spreads are 70% better than the industry standard for major currency pairs.

To give a bit more detail, for the EUR/USD spread, Eightcap boasts a mere 0.06 pips. That's a 72.7% improvement over the industry average of 0.22 pips. At 0.2 pips, the USD/CAD spread is also close to 70% times lower than the industry average, while the AUD/JPY and USD/JPY are both over 40% tighter than industry average spreads.

The Raw Account: Optimised for experienced traders

Catering to traders who have moved beyond the beginner phase and are keen on enhancing their cost efficiency, the Raw account allows you to fully capitalise on the aforementioned tight spreads. Minimum spreads start at 0.0, however you will pay a $7 AUD round-turn commission for each trading lot.

"As an account perfectly tailored for seasoned traders, the Raw Account offers a trade-off between commission fees and ultra-competitive spreads," says Justin Grossbard from CompareForexBrokers.com.

MetaTrader 4, MetaTrader 5 and TradingView trading tools

While Eightcap has yet to invest in a proprietary platform, its MetaTrader 4 and MetaTrader 5 offerings don't disappoint when it comes to features. The broker also features TradingView as a platform add-on.

- MT4 includes a comprehensive set of tools for automated trading, an array of charting options, and real-time pricing.

- MT5 widens the scope beyond forex for those interested in exchange-traded products. It also offers 21 timeframes, six types of pending orders, and provides real-time market updates.

- TradingView comes with over 100 charting options and ability to share trading ideas from its community of 50 million users.

Eightcap's financial products

Eightcap isn't limited to Forex products; its range of CFD products is impressively diverse.

- Forex: A selection of over 40 currency pairs.

- Commodities: More than just gold and oil, you can diversify into silver, natural gas, and agricultural commodities like wheat.

- Indices and Stocks: Access to both global indices and individual shares.

- Cryptocurrencies: 87 cryptos vs USD, including Bitcoin, Ethereum and Cardano.

Eightcap weaknesses

- Limited educational resources

While Eightcap is exceptional in many areas, no broker is perfect. Their educational content could be more extensive.

Eightcap verdict

With spreads that exceed industry standards by over 70 per cent, Eightcap is designed for traders who truly understand the value of each pip.

- Spreads that exceed industry averages

- MetaTrader 4, 5 and TradingView support

- Extensive CFD offerings across various markets

Regulated by the Australian Securities and Investments Commission (ASIC), Eightcap offers a trading environment that's both secure and transparent.

2. Pepperstone - Best broker for automated trading

Pepperstone is our pick as the leading choice for those of us relying on automated trading. Their setup and foundational infrastructure are distinctly crafted to support this trading approach, thanks to MetaTrader EAs, Capitalise.ai and social or copy trading with Myfxbook, DupliTrade and MetaTrader Signals.

Pepperstone benefits

- Expert Advisors on MetaTrader 4 and MetaTrader 5

- Trading costs are low, mimicking ECN environments

- Execution is speedy, with minimal slippage

ECN environment for automated trading

Pepperstone's excellent tech infrastructure means you benefit from fast execution speeds - a must for effective scalping strategies and high-volume trading.

By collaborating with Equinix and leveraging their NY4 (New York) and LD3 (London) data centres, Pepperstone reduces the lag time between when you place your order and when its servers complete the transaction. This is crucial in automated trading, where even the smallest of time delays can influence the spread you will pay.

The Razor account is designed for high-volume traders, featuring interbank pricing and a fixed commission of just $3.50 AUD per side. For those with more hefty portfolios, the Active Traders Program is worth a glance.

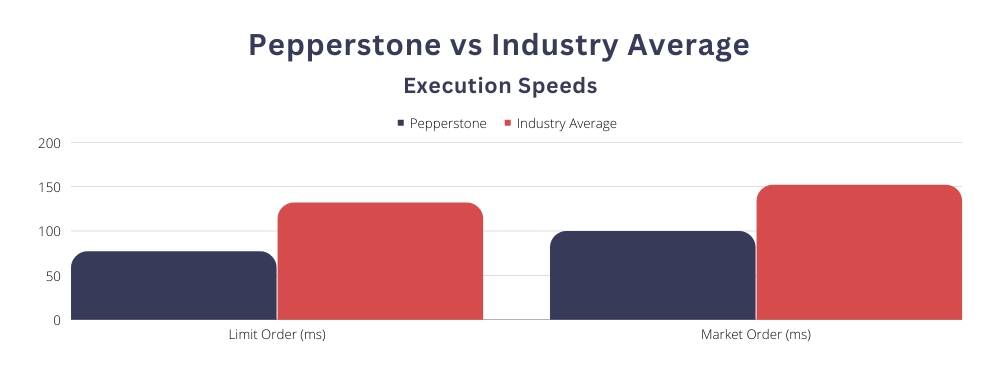

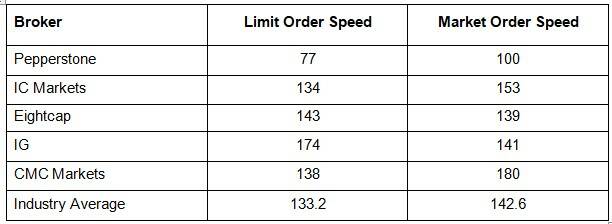

Execution speeds: The data

When we compared Pepperstone alongside 20 other brokers, they consistently excelled in the execution speed category.

Pepperstone topped the list for limit order execution speeds at 77 milliseconds, which is 42.3% faster than the industry average. Its market orders averaged 100 milliseconds.

Trading Platforms Tailored for Automated Trading

Pepperstone offers a range of platforms tailored to different trading strategies:

- MetaTrader 4: A staple for automated forex trading, fully supporting Expert Advisors.

- MetaTrader 5: Suitable for automated CFD trading with more advanced charting features.

- cTrader: Ideal for experienced traders, offering in-depth market information and quick order execution.

- Capitalise.ai: A no-code solution for automated trading.

- TradingView: A community-driven platform that excels in advanced charting.

Automated trading tools

If you live and breathe Expert Advisors and all things algorithmic trading, Pepperstone's Smart Trader Tools make a welcome add-on to your preferred Metatrader platform. A suite of 28 smart trading apps, the Smart Trader Tools are designed to expand your EA's capabilities.You can also use Capitalise.ai with an MT4 account for trading with no code knowledge and copy other traders via Myfxbook or Duplitrade.

Ross Collins from CompareForexBrokers.com liked the Trade Simulator EA that comes with MetaTrader. "The Trade Simulator for backtesting EAs on the MT4 platform is invaluable. The execution speeds further boost the performance of EAs that focus on scalping or high-frequency strategies".

Pepperstone weaknesses

- Less competitive Standard Account pricing

Pepperstone's Standard Account spreads start from 1 pip, which isn't the most competitive, especially when compared to some of the best brokers offering commission-free account types.

Pepperstone verdict

If you prioritise swift execution and an EcN-like trading environment, Pepperstone ticks all the boxes.

- ECN-Like Pricing

- Support for MetaTrader 4, MetaTrader 5, cTrader and TradingView

- Robust Options for Automated Trading

Regulated by both ASIC in Australia and the Financial Conduct Authority (FCA) in the UK, Pepperstone provides a trading platform that you can trust to be both transparent and secure.

3. IC markets - Lowest no commission spreads

IC Markets distinguishes itself with notably low spreads and commission-free trading. After analysing data from 40 brokers, it's clear: this online broker offers value.

IC Markets Benefits

- Commission-free trading with lower spreads than industry averages

- Minimal trading fees

- MetaTrader 4 for commission-free forex trading

Tight spreads with no commission

In a marketplace where minor variations in spreads can make a major difference, IC Markets stands out.

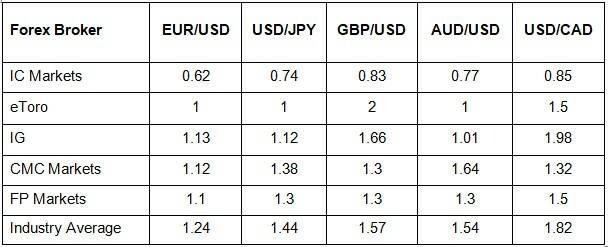

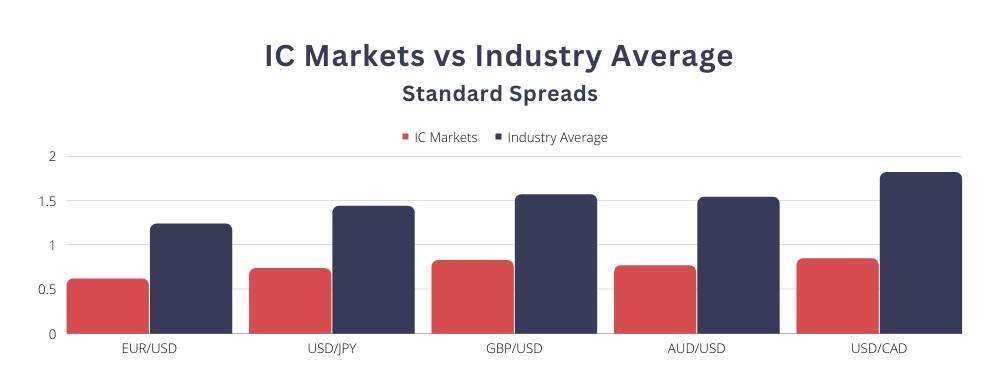

Take the EUR/USD pair as an example. IC Markets spreads average 0.62 pips, a 50% reduction from the industry's standard of 1.24 pips.

It's not just the EUR/USD; the USD/JPY also stands at a spread of 0.74 pips with IC Markets. The broker's spread is about 49 per cent less than the industry standard of 1.44 pips.

The GBP/USD and AUD/USD pairs also follow this pattern, offering notably lower spreads when compared to industry averages.

Standard account for commission-free spreads

The Standard Account from IC Markets is our pick as a solid all-around trading account. Spreads can be as low as 0.6 pips, and you can choose between AUD or USD for your account currency. It may also help to know that there are no inactivity fees, and it's available as a swap-free account for Islamic traders.

Additionally, IC Markets presents a broad spectrum of payment avenues to fund your account, from your standard credit and debit cards to bank transfers and even a range of e-wallets such as PayPal and Skrill. This variety ensures you have ample choices when it comes to fund management.

MetaTrader 4 and 5 and testing trading strategies

IC Markets offers both Metatrader 4 and 5 platforms. Balancing user-friendliness and advanced technical capabilities, the MetaQuotes family of platforms successfully caters to traders of all skill levels. With the vast suite of technical indicators and analytical objects, these platforms are our pick as they provide you with the market analysis tools you need to make trading decisions.

You will also get unlimited access to their demo accounts to test out the broker or practice trading. These demo accounts mirror real-time market dynamics,allowing you to test out your trading strategies before using your own funds.

In our experience, the combination of MetaTrader 4 and 5 along with the use of demo accounts from IC Markets provides a comprehensive, user-oriented trading backdrop that will allow you to better familiarise yourself with trading and refine your trading strategies.

IC markets weaknesses

- No proprietary mobile app

- Limited market research tools in some areas

While IC Markets doesn't offer a proprietary mobile app, its compatibility with established third-party platforms compensates for this. On the front of market research tools, while they do extend certain resources, the scope isn't as extensive as some other online brokers out there. This might warrant further attention for those leaning heavily on intricate market analyses.

IC markets verdict

IC Markets stands as a great choice if you prioritise low-cost, commission-free trading.

- Exceptionally low spreads across key currency pairs

- User-friendly and accessible Standard Account type

- The reliability of MetaTrader 4 for both newcomers and algorithmic traders

IC Markets operates under the regulatory oversight of the Australian Securities and Investments Commission (ASIC) for Australian traders along with the Seychelles Financial Services Authority (FSA), and the Cyprus Securities and Exchange Commission (CySEC) for traders in Europe and other countries.

4. eToro - Best Copy Trading CFD Broker

eToro is an online brokerage that has managed to differentiate itself in the crowded forex market with a game-ified approach to social and copy trading.

eToro Benefits

- A global user base spanning over 140 countries

- Innovative CopyTrader and CopyPortfolio functionalities

- Financial rewards for savvy traders

Global leader in social trading

eToro didn't just join the social trading movement - they were at the forefront of its evolution. The platform is built from scratch with social trading as its primary focus. This shift transformed how traders communicate, share knowledge, and even replicate each other's investment choices.

With the brokers extensive user base spanning over 140 countries and useful filtering tools, we were able to find exactly the type of signals or traders we wanted to follow and copy.

Filters available include location, risk metrics, and trading performance, all features which help us to select traders that resonate with our investment objectives. This is the pinnacle of social trading, giving us a gateway to connect with a global assembly of traders and stay updated when our favourite traders share fresh insights.

Moreover, eToro goes beyond the basic premise of copy trading. Their platform is enriched with social feeds that foster interaction, allowing you to share and gain insights or trade opinions. The built-in alert system for pertinent market shifts or asset variances ensures that you remain well-informed and proactive.

Copytrader and copyportfolio features

At the core of eToro's copy trading mechanism are its proprietary features: CopyTrader and CopyPortfolio.

CopyTrader allows you to emulate the investment patterns of traders we like seamlessly, CopyPortfolio lets you broaden our investment scope by replicating a diverse array of traders or assets. These features can be instrumental in widening your investment perspective and drawing inspiration from market experts.

Incentives for top traders

eToro takes a unique approach to rewarding skilled traders for sharing their strategies. Suppose you find yourself among the top-performing traders, in that case, there's potential to accrue additional earnings - up to 2 per cent of your supervised assets - solely for being a model for other traders to copy. This win-win setup not only motivates seasoned traders but also assures newcomers of access to vetted and reliable strategies.

eToro weaknesses

- Spreads are on the higher side

- Customer service lags behind local Australian forex and CFD brokers

eToro adopts a fee structure that revolves around wider spreads, kicking off at 1 pip. If you are looking for the tightest spreads in the market, you might find eToro a bit steep. Additionally, the absence of direct phone support and personalised account management makes the broker less appealing if you prefer a more hands-on service approach.

eToro verdict

eToro is the go-to platform for you if you find the prospect of copy trading appealing and like the idea of using the eToro community to share and get trading ideas.

- Excellent ecosystem for real-time social trading and knowledge sharing

- Financial bonuses that encourage participation from both beginner traders and veterans

eToro is regulated by multiple high-tier financial authorities including ASIC, CySEC, FCA, and FinCEN.

5. Fusion markets - Forex broker with the lowest commission

Fusion Markets is our preferred platform when prioritising costs. It's not the sleekest or sppediest of brokers, but does offer a solid, no-frills experience at low cost.

Fusion markets benefits

- Commission fees 26-35% lower than industry standards

- No fees for deposits and withdrawals

- No minimum deposit

Unbeatably low fees

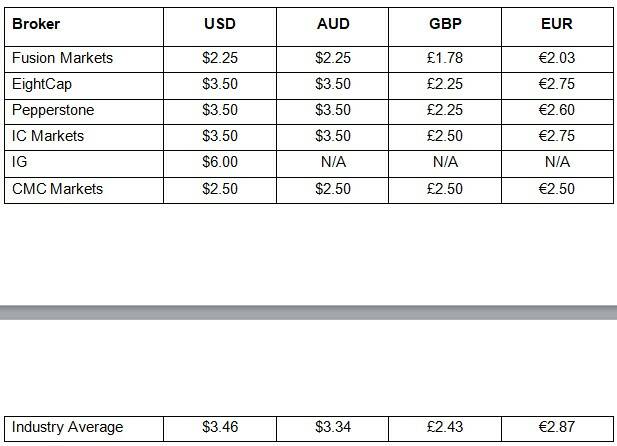

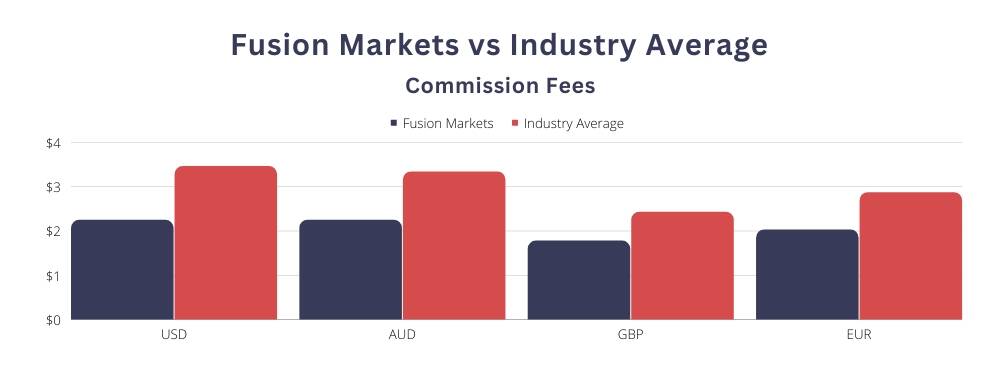

In a market teeming with competition, Fusion Markets has marked its territory with the most competitive commission rates. This broker only charges $2.25 AUD per trade, significantly lower than the overall average industry rate (from the brokers we collected) of $3.34 AUD, representing a savings of 32.6%.

Comparing Fusion Markets to other top forex brokers reveals their competitiveness. Pepperstone, IC Markets and Eightcap all charge $3.50 AUD.

"As someone who's spent years analysing forex brokers, these figures caught my eye. With commission fees as low as $2.25 AUD per trade, Fusion Markets undercuts the industry average by over 30%. It's a quantifiable advantage that gives traders an immediate edge in cost efficiency," says Justin Grossbard from CompareForexBrokers.com.

With this commitment to low costs, Fusion Markets has a lot to offer if you're a cost-conscious trader, either in Australia or globally.

Easy deposits and a range of funding methods

In our experience, Fusion Markets truly excels in the realm of cost-effectiveness. This online broker charges no deposit or withdrawal fees, although international wire transfers may incur third-party fees. With no initial deposit required to begin trading, the entry hurdles are incredibly low.

We've taken advantage of their diverse deposit and withdrawal methods, from standard bank transfers to the convenience of credit cards, debit cards, and e-wallets such as Skrill and Neteller.

MetaTrader 4 & 5 and cTraderPlatforms

Fusion Markets offer the ever-dependable MetaTrader 4 and 5, as well as cTrader for Depth of Market (DoM) trading.

With three trading platforms from which to choose, each with different features, Fusion Markets aspires to cater to a wide variety of traders, ensuring there's a platform tailored to align with individual trading approaches.

Fusion markets weaknesses

- Inactivity fees after 12 dormant months

- A limited range of 100 share CFDs

One thing to remember is the monthly inactivity fee charged after 12 months without trading activity. Additionally, the limited range of just 100 share CFDs might feel narrow, especially when compared to the broader portfolios of competitors.

Fusion markets verdict

Fusion Markets is the broker you turn to when you want to trim your trading expenses without skimping on quality.

- Ultra-competitive commission fees

- No minimum deposit

- A range of trading platforms to suit all preferences

Regulated by ASIC and VFSC, Fusion Markets ensures a secure trading space for its clients.

![Anchor Anchor]() 6. OANDA - Best broker for beginner forex traders

6. OANDA - Best broker for beginner forex traders

OANDA is one of the best brokers globally when it comes to beginner-friendly forex trading platforms. The online brokers proprietary platform is designed to be user-friendly, and the comprehensive educational materials make it an ideal launchpad for those just starting out.

OANDA benefits

- User-centric platforms that beginners can easily navigate

- A rich collection of educational content including tutorials and courses

- Real-time, interactive webinars for instant learning and query resolution

Versatile forex trading platforms

When we first explored OANDA's trading platform, its user-friendly design immediately caught our attention along with its extensive range of technical indicators or charts. One feature we really liked is the availability of a Guaranteed Stop Loss Order (GSLO) which is a very useful tool to protect your trades when movements are unfavourable.

OANDA offers three trading platforms: OANDA Trade(web and mobile), MetaTrader 4, and TradingView. This variety allows you to select the most comfortable platform for you.

If you are just starting your trading journey, we think the OANDA Trade platform stands out. With this platform, you will get TradingView charts meaning over 100 charts and analysis tools which many say is the best in the industry along with a GSLO for better risk management. We think OANDA Trade strikes a good balance between ease of use and adaptability, supporting you as you become more familiar with trading nuances.

To ensure your needs are met, OANDA Trade is equally adaptable if trading from your desktop via a web browser or keeping an eye on the markets on the move via their mobile app version.

Comprehensive educational resources for beginner forex traders

OANDA's educational content is notably detailed, extending beyond the standard glossaries and FAQs we've seen on other platforms.

Justin Grossbard from CompareForexBrokers.com offers his insights on OANDA's educational offerings.

"OANDA excels in educational resources, making it invaluable for beginners. Their MarketPulse website is chock-full of articles that are updated multiple times a day, encompassing a broad spectrum from market trends to trading tactics. An accompanying online course covering both fundamental and technical analysis basics further enhances the learning experience for new traders."

What particularly resonated with us was OANDA's live webinars. These sessions aren't merely pre-recorded videos; they're real-time and interactive, letting you engage and get instant answers, making complex trading concepts easily digestible.

OANDA weaknesses

- Limited to forex and crypto

- No share CFDs on offer

OANDA might be strong in the forex and crypto arena, but they do not offer share CFDs. If diversifying your portfolio with share CFDs is crucial for you, you'll need to look elsewhere.

OANDA verdict

OANDA serves as an excellent platform if you are a novice to trading. Their comprehensive and interactive educational materials effectively simplifies the forex trading initiation process for you.

- Easy-to-navigate trading platforms ideal for beginners

- A range of platform choices including OANDA Trade and MetaTrader 4

- In-depth educational materials complemented by live webinars

Based in the United States, OANDA is under the regulatory supervision of authoritative bodies like the Commodity Futures Trading Commission (CFTC) in the U.S. and the Financial Conduct Authority (FCA) in the UK, as well as ASIC in Australia.

7. IG - Australia's largest retail forex broker

Beyond just a trading platform, IG offers an expansive trading environment enriched by decades of expertise having been founded in 1974.

IG Benefits

- A legacy stretching back nearly half a century

- A broad spectrum of CFDs

- Next-level tools for market and technical analysis

Diverse market access

We've found IG to host an expansive trading centre, with some 17,000+ products available including CFDs, spot products and even options and futures. 68 CFD forex pairs are available along with indices, commodities, shares CFD, cryptos and even interest rates and bonds to pique your interest. You can even buy proper shares rather than simply betting on market movements..

Trading platforms and technical analysis tools

When it comes to the trading platforms offered, IG Markets allows you to choose from 4 types of trading platforms.

Their custom-built 'core platform' known as IG Trading Platform stands out for combining ease of use with expensive trading capabilities. Both newcomers and veterans like us have found value in its features, with its straightforward layout, 28 indicators and 19 drawing tools for in-depth analysis plus integration with ProRealTime for further analysis tools. You can also make use of guaranteed stops to ensure you exit at the price you nominate.

If, however, you prefer a platform that's well-established and globally recognised, then you can opt for MetaTrader 4. Recognised worldwide, MetaTrader 4 caters to those who appreciate a mix of familiarity and versatility. If you wish to automate your trading, the expert advisors (EAs) available with MT4 is our suggested option.

Two other platforms are available, these being another in-house developed platform called L2 Dealer for Direct Market Access (DMA) trading and ProRealTime. ProRealTime is a paid product but has extensive analysis tools making it a good choice for technical chart users, as a bonus, you can even automate your trading. .

Both these platforms are enhanced with a selection of complimentary trading tools aimed at refining our trading strategy. This fine-tuning is possible when you access premium analysis and insightful market research tools.

IG Weaknesses

- Limited range of cryptocurrency CFDs

- Inactivity charges for dormant accounts

While IG Markets excels in many areas, it does have a couple of drawbacks. For instance, cryptocurrency enthusiasts might find their options somewhat lacking in variety.

Moreover, occasional traders should be mindful of inactivity fees. Much like some other top-tier brokers, IG Markets will charge you if your account is inactive for an extended period.

IG Verdict

IG makes a great choice if you're looking for diversified investment options and advanced trading tools.

- A reputation built over 50 years

- A selection of over 17,000 CFD products

- A suite of high-end analysis tools

IG is headquartered in London and falls under rigorous regulatory oversight from bodies like the FCA and ASIC.

8. FP Markets - Best forex broker for MetaTrader 4

In our journey to harness the full potential of MetaTrader 4, we found that FP Markets, regulated by ASIC and based in Sydney, should be a top consideration for any trader.

FP markets benefits

- MetaTrader 4 laden with avant-garde trading utilities

- One-click trading feature along with customisable notifications

- Connection to MQL4 community and marketplace

Meta Trader 4 forex platform

Our experience with FP Markets significantly elevated the MetaTrader 4 platform, blending personalisation and user-friendliness. Regardless of whether we used an Apple or Android device, we found the platform more than able to meet our needs.

A standout feature for us was the one-click trading utility - an invaluable tool for traders who need to respond quickly in unpredictable markets.

Beyond a flexible MetaTrader 4 interface, FP Markets enhances it with premier charting tools, live pricing information, and current market updates. Additional MT4 trading tools we noted were:

- Interface Customisation: MT4 with FP Markets lets you personalise the visual elements of technical markers, simplifying data interpretation.

- Expert Advisors (EAs): Are you into algorithmic trading? MT4's compatibility with EAs facilitates high-speed trade executions, which is a particular boon when you're trading through FP Markets.

- Alerts Tailored to Your Needs: Receive timely updates on specific market conditions, so you never skip a beat in your trading journey.

- MQL4 Community and Marketplace: Extend your trading arsenal by downloading custom indicators and trading scripts.

While we listed FP Markets as being a good choice for MetaTrader 4, we should mention they also offer MetaTrader 5 along with IRESS. IRESS is designed for CFD share trading and uses direct market access (DMA) to bring you the best prices.

FP markets weaknesses

- Limited asset range on MetaTrader 4

- Not the most beginner-friendly platform

While we appreciate FP Markets for its numerous advantages, there are aspects where improvement is needed. If you're looking to expand your portfolio with ETFs or share CFDs, the MetaTrader 4 platform at FP Markets might be disappointing due to their unavailability.

Moreover, for those just beginning in the trading realm, FP Markets' MetaTrader 4 could prove to be a steep learning curve due to its complex range of features and tools.

FP narkets verdict

Specialising in MetaTrader 4, FP Markets demonstrates a commitment to delivering a feature-rich, trader-focused experience.

- MetaTrader 4 comes well-equipped with trading utilities

- One-tap trade executions and custom alerts for an efficient trading process

- An extensive MQL4 community and marketplace for an expanded suite of trading resources

With its headquarters situated in Sydney, FP Markets operates under the strict regulatory oversight of the Australian Securities and Investments Commission (ASIC).

9. CMC markets - Best broker for share and forex trading

Established in 1989, CMC Markets is no newbie in the trading scene. The online broker's market access is likewise impressive with 10,000 CFD products ranging from forex to shares to crypto and also has shares trading.

CMC Markets Benefits

- More than 35,000 physical shares and 10,000 share CFDs

- Over 330 forex pairs

- A variety of trading platforms specifically tailored for forex and CFD trading

Extensive share market access

What sets CMC Markets apart is its double-pronged approach: CFD services and a distinct stockbroking platform. If you're on Australian soil, CMC Markets stands out as one of the select few that provides access to actual share trading in addition to CFDs.

For CFD share trading, the broker presents a selection of platforms, including both MetaTrader 4 and their sophisticated NGEN platform. Furthermore, the commission rates are transparent and competitive, dropping to as low as 0.04% for shares on the ASX market. With CMC Markets, we traded UK shares at a 0.08% commission and US shares at .02 cents per unit.

Our experience with CMC Markets was positive for those passionate about currency trading. They offer a vast range of currency pairs, from your standard EUR/USD to your more exotic EUR/TRY.

Other financial products

CMC Markets offers a wide scope of other financial instruments. Whether you're into commodities such as gold or drawn to the dynamic realm of cryptocurrencies like Bitcoin, they've got it covered. Additionally, a diverse array is on hand for traders interested in market indices or ETFs, enabling you to place broader wagers without concentrating on individual stocks.

CMC markets weaknesses

- Spreads could be narrower

- Inactivity fee

If you're someone who's very cost-conscious, you might find the spreads a bit wider than what you'd get with brokers like Eightcap and Pepperstone. Similarly, if you're not consistently active in your trading, be prepared to face inactivity fees.

CMC markets verdict

CMC Markets is your go-to if you're keen on diving into a broker offering over 10,000 CFD products including 330 forex pairs and also has share trading.

- Three decades of a strong presence in the industry

- An expansive array of shares and forex pairs

- Varied platform choices for a bespoke trading experience

Headquartered in London and regulated by none other than the FCA in the UK and ASIC in Australia, CMC Markets has built a sturdy platform that meets the trading needs of Aussies quite admirably.

10. Plus500 - Best proprietary mobile trading app

In the competitive landscape of the forex market, Plus500 has distinguished itself with its proprietary mobile trading app. User-friendly and adaptable, it's our top choice for traders seeking a smooth experience while trading on the move.

Plus500 benefits

- User-friendly mobile apps for both Android and iOS

- Zero charges on withdrawals

User-friendly mobile app

Departing from the traditional MetaTrader, they've introduced their own bespoke platform optimised for all mobile devices, whether Android or iOS.

The app's clean, easy-to-navigate interface jumped out at us for its clean, accessible interface. It delivers real-time stock and forex quotes and timely price alerts, which are crucial for informed technical analysis and strategy planning.

The app's emphasis on streamlined trading ensures that all vital details required for trade execution are right at your fingertips. We believe it's a worthy tool for traders, both newcomers and those with some experience under their belt.

If you're a beginner or on the more conservative side, Plus500 is one of only a handful of brokers to offer a Guaranteed Stop Loss Order. You'll also enjoy the peace of mind that comes with negative balance protection.

Hassle-free deposits and withdrawals

Plus500 keeps deposits and withdrawals simple. Whether it's credit cards, bank deposits, or e-wallets, there's an option for you. Multiple base currencies also help you dodge unwanted conversion fees.

In terms of withdrawals, they're as uncomplicated as they come. Once you've verified your account, you can pull out your funds back to the original source without incurring any charges.

Plus500 weaknesses

- Absence of instant customer service

- Mobile app not designed for advanced trading

We must point out that Plus500's lack of immediate customer support could be a potential roadblock. Also, advanced traders might find the mobile app lacking in terms of comprehensive features and tools.

Plus500 verdict

Specialising in mobile trading, Plus500 presents an app that strikes the right balance between user-friendliness and rich functionality, seamlessly working on both Android and iOS platforms.

- Intuitive mobile app

- Zero withdrawal charges

- Diverse base currency options

Plus500 is regulated in multiple jurisdictions including by the Financial Conduct Authority (FCA) in the UK and also by the Australian Securities and Investments Commission (ASIC).

Summary of the best forex brokers

After extensive research and data analysis on over 40 forex brokers, the list we've compiled is anything but arbitrary. From Eightcap's phenomenal spreads to Pepperstone's unrivalled speed in trade executions and IC Markets' exceptional low spreads, each broker brings something unique to the table.

The insights we're sharing are designed specifically for Australian traders looking for more than just the fundamentals from a forex trading platform. Whether you're seeking tight spreads, low fees, lightning-quick execution speeds, or a broad range of CFD options, there's a broker in our list suited to your needs.

What is CFD trading?

Contract for Difference (CFD) trading is an investment approach where you speculate on the price fluctuations of financial markets, be it forex, commodities, or indices, without actually owning the underlying asset. The appeal lies in its flexibility and the application of leverage. But bear in mind, while leverage can magnify your profits, it's a double-edged sword that also escalates your potential losses.

Does Australia allow forex trading?

Yes, Forex trading is allowed in Australia. The country boasts a solid financial market, and Forex trading is recognised and widely embraced. While an ASIC-monitored regulatory framework exists, the overall setting favours forex traders, affording them a transparent and secure trading space.

Who is ASIC and what's their role?

The Australian Securities and Investment Commission (ASIC) is the watchdog overseeing financial markets in Australia, which includes the forex market. They grant Australian Financial Services Licences (AFSL) and ensure that trading environments are transparent and fair for retail investor accounts as well as professional traders.

ASIC is instrumental in reducing high-risk foreign exchange trading and shielding traders from fraudulent activities in derivatives and other financial markets. However, being ASIC-regulated doesn't mean you're entering a risk-free zone; it simply adds a layer of safety.

What do financial authorities do?

Financial authorities are indispensable in upholding market honesty, safeguarding investors, and ensuring overall equilibrium within the forex trading universe. We've personally observed the significant impact these regulatory entities have on brokers and traders alike. They establish regulations (like setting leverage caps and mandating disclaimers), enforce adherence, and ensure that traders like ourselves operate in a protected environment. Notable examples are:

- CySEC (Cyprus, Europe)

- FINMA (Switzerland, Europe)

- FMA (UK)

- CIRO (Canada)

- FMA (New Zealand)

Do traders pay tax in Australia?

Yes, Forex trading is subject to taxation in Australia. Profits are subject to taxation, and you're obligated to declare these earnings on your annual income tax return. The Australian Tax Office (ATO) views these profits as income, so the applicable tax rate varies based on your overall income for the year. Neglecting to report your trading income can result in hefty penalties from the ATO, making it crucial to consult a tax advisor to ensure compliance.

Can you trade forex in New Zealand?

Yes, you can trade forex in New Zealand. The country has a well-regulated forex market, and many international brokers offer their services there. New Zealand forex markets are regulated by the Financial Markets Authority (FMA).

How big are Forex markets?

As of April 2022, its estimated worth stands at $2.73 quadrillion (up from $1.93 quadrillion in 2019), with a daily trading turnover of $7.5 trillion. To offer some perspective, this market overshadows the combined US stock and bond markets by about 30 times. Such magnitude presents forex traders with unmatched opportunities for both profit and diversification.

Who are Australia's largest brokers?

IC Markets, an Australian brokerage, consistently leads the pack as the largest online forex broker worldwide, boasting an impressive daily turnover of $22.68 billion. Meanwhile, Forex.com, hailing from the United States, has surged in popularity, pushing XM down to take the second-place position in terms of trading volume.

Is MT4 legal in Australia?

Yes, MetaTrader 4 (MT4) is completely legal to use in Australia for forex trading. It's one of the most popular trading platforms globally and is fully supported by a range of brokers regulated by the Australian Securities and Investments Commission (ASIC).

What trading platform to use in Australia?

MetaTrader 4 and MetaTrader 5 stand out as the go-to platforms in Australia. They offer a broad range of features that cater to both novice and experienced traders. The best CFD providers like Eightcap and Pepperstone offer both MT4 and MT5. These brokers not only provide MT4 and MT5 but also enhance them with supplementary educational materials and unwavering customer support, smoothing out the overall trading trajectory.

How do I open an account and start trading forex?

Kicking off your online trading journey in Australia is straightforward. First, you'll want to select a broker regulated by ASIC with features that support your trading goals. After signing up, you'll be required to provide identification proof for authentication. Once your account is verified, it's time to deposit your initial funds. Many brokers provide the option of a demo account, which we highly recommend you utilise for practice before entering live trades. When you feel ready and confident, you can proceed to live trading.

Remember, starting off with an ASIC-regulated broker gives you an extra layer of protection and significantly minimise your exposure to potential scams or high-risk trading conditions.

Why do so many traders fail?

Poor risk management is a major issue. Many traders get carried away by emotions or become overconfident after a few successful trades. Inadequate knowledge of the market and online trading without a strategy are other common pitfalls.

Is forex more risky than stocks?

Forex trading offers both high rewards and risks. The market's pulse can shift rapidly due to factors like economic announcements, interest rate shifts, or geopolitical currents. In contrast, stocks predominantly dance to the tunes of individual company outcomes and overarching market trends. Generally speaking, stocks are perceived to exhibit less volatility, making them somewhat safer than forex.

Which is better forex or crypto?

Forex trading is generally more stable and operates within well-regulated markets. Cryptocurrency trading can offer potentially higher gains but comes with greater volatility and regulatory risks. The ball's in your court; it boils down to your trading style and risk appetite.

Can you trade forex with $500?

Yes, $500 is more than enough to dip your toes into the forex market and start online trading. Various brokers offer mini and micro accounts, ideal for low-budget trading. However, one thing to be cautious about is that a lower budget may restrict your ability to diversify and manage risk effectively.

- This information is of a general nature only and should not be regarded as specific to any particular situation. Readers are encouraged to seek appropriate professional advice based on their personal circumstances.

- Disclaimer: This story may include affiliate links with PropCompanies partners who may be provided with compensation if you click through. ACM advises readers consider their own circumstances and needs. You should verify the nature of any product or service, and consult with the relevant regulators' website before making any decision.