5 Small business startup costs you need to know

This is branded content.

It's an exciting endeavour to launch a small business, but it needs careful planning and money management. Knowing the initial costs of starting a small business is one of the most important things to do. The charges you will have to pay before your business starts making money are known as startup costs. You may estimate how much money you'll need to launch your firm and how long it will take to turn a profit by being aware of these expenditures.

Key takeaways:

- Starting a small business requires careful planning and financial management using reputable accounting software.

- Common business startup costs include legal fees, permits and licenses, equipment and supplies, marketing and advertising expenses, and initial inventory.

- Calculating your initial investment is an essential step in starting a small business. A useful tool is this new business calculator.

5 Business startup expenses you may encounter

It's critical to budget for a variety of necessary costs when launching a small business to guarantee a successful launch and operation. Small business owners can steer clear of financial traps and position their operations for success by being aware of these expenses and creating a budget for them.

1. Legal and administrative fees

Establishing the administrative and legal foundation for your company is essential. It could be necessary to set aside money for costs associated with obtaining licences, permits, and legal advice for your firm. The nature of your business and your location may have an impact on these expenses.

2. Business insurance costs

It's critical to safeguard your company with the appropriate insurance coverage. Depending on your sector and particular needs, budget for property, workers' compensation, professional liability, and general liability insurance.

3. Marketing and advertising

To advertise and market your company and draw clients, you must make marketing and advertising investments. Set aside money for costs associated with developing a logo, printing promotional materials, launching online advertising campaigns, and building a website.

4. Technology and equipment

Purchasing computers, software, point-of-sale (POS) systems, and other essential tools for your business operations are examples of technology and equipment expenses. Take into account both one-time and recurring costs (e.g., subscription fees) for maintenance and upgrades.

5. Inventory and supplies

Set aside money for your company's first inventory and supply purchases. Having the appropriate supplies and inventories, regardless of what you're selling, is essential to satisfying client demand and providing value.

Things you can do to minimise startup costs

Here are two vital small business tips to reduce the upfront costs when launching or running your small business:

- Start off slowly. Using the lean startup model can help new businesses launch with much lower startup expenses. You can avoid making significant investments in product development before comprehending market demand by concentrating on developing a Minimum Viable Product (MVP) and gathering user feedback. This method lowers the chance of overspending on superfluous features and helps you use resources more effectively.

- Outsource and hire when appropriate. Thoroughly evaluating whether to engage internal workers or outsource specific services is another approach to reducing beginning costs. Accounting, marketing, and IT support are examples of non-core business operations where outsourcing can be a financially advantageous option. You can obtain specialised knowledge without having to pay for full-time staff overhead. However, employing internal personnel might ultimately be more advantageous for jobs that call for tight integration with the main corporate activities.

Common types of startup costs you may encounter

Establishing a small business entails a range of costs that fit into distinct categories. Comprehending these expenses is vital for proficient financial planning and budgetary management. The following are typical start-up expenses you could experience.

Fixed vs variable costs

It is critical to distinguish between fixed and variable costs while starting a business. Fixed costs include expenses like rent, business insurance, and salaries that don't change based on the volume of sales or output. Conversely, variable costs-like commissions, utilities, and raw materials-change in response to business activity. Identifying and classifying these expenses can assist you in efficiently managing your budget.

Capital expenditures

The initial investments you make in assets like machinery, cars, and equipment that are necessary for your firm to run are referred to as capital expenditures. These charges are typically one-time costs that support your company's long-term expansion and productivity. Effectively evaluating and allocating funds for these costs is essential to a successful launch of a firm.

Operational expenses

The daily costs of operating your business, such as marketing, utilities, office supplies, legal fees and using accounting software to keep track of financials, are included in operational expenses and these will be incurred over the lifetime of your business. These costs are regular and essential to the continuous running of your company. It is essential to comprehend and keep an eye on these expenses to preserve sustainability and financial stability.

Calculating the initial investment

Depending on its nature, it might take a large financial outlay to launch a small business. Establishing your startup costs is a crucial step before you launch your company to assess its initial viability. The two primary processes in determining your first investment - budgeting for start-up expenses and forecasting income and cash flow - will be covered in this section.

Budgeting for business startup costs

Finding your startup costs is the first step in figuring out your initial investment. The expenses you will have before you begin making money are known as startup costs. These expenses cover anything from inventory and equipment to marketing and legal fees.

Make a note of every price you anticipate incurring before you begin budgeting for your beginning fees. To make a thorough budget, utilise accounting software or a spreadsheet. Make sure to account for both one-time costs like purchasing equipment and continuing costs like rent and utilities.

You may figure out how much money you need to start by adding up all of your startup expenditures once you have a list of them. When making your budget, it's critical to be as precise as possible because underestimating your initial expenditures can cause cash flow issues later on.

Estimating revenue and cash flow

To determine your initial investment, you must first assess and solve potential issues with your cash flow and revenue. Cash flow is the quantity of money that comes into and goes out of your organisation, whereas revenue is the amount of income your company makes.

You should carry out market research to ascertain the level of demand for your good or service before estimating your income. This data can be used to project how much money you will be able to make in your first year of business.

A good method is to make a forecast to estimate your cash flow. You can use this projection to estimate how much cash you will have available each month. This information might help you decide if you need to get more funding to make up for any deficits.

One of the most important steps in launching a small business is figuring out your initial investment. You may figure out how much money you need to start and make sure you have enough cash on hand to cover your expenses by making a budget for your startup costs and projecting your income and cash flow.

Funding your business

Sufficient capital is needed to launch a small business and pay for things like inventory, marketing, and equipment. Some of the funding alternatives for your small business are listed below.

Self-funding

Self-funding is an option that many small business owners use to finance their startups. This involves using personal savings, selling personal assets, or borrowing from friends and family. Self-funding allows you to have full control over your business without having to share ownership with others.

Seeking investors

Look for investors as an additional source of cash for your small business. In exchange for shares or a cut of the income, investors can give you the startup financing you need. Make sure you have a strong business strategy and a clear understanding of your financial expectations before looking for investors since you need to sell the idea to them including their return on investments.

Small business loans

For some, small business loans are a common source of capital. Banks, credit unions, and other financial institutions are the sources of these loans. But beware, requirements for small business loans usually include collateral and a high credit score. They do, however, provide flexible repayment arrangements and reasonable interest rates but this may not be for every situation.

Government grants and subsidies

Depending on the industry niche, owners of small businesses who fulfil specific requirements can apply for grants and subsidies from government agencies. These grants, which come from different government organisations, can be used to pay for R&D, startup fees, and other costs associated with running a business. You must fulfil specific eligibility conditions and submit a thorough business plan to be eligible for government grants and subsidies. Examples of industries where government grants and subsidies may be applicable include technology and aged care.

Financial planning and management

Starting a small business requires careful financial planning and management to ensure its success. Small business owners should consider the below points.

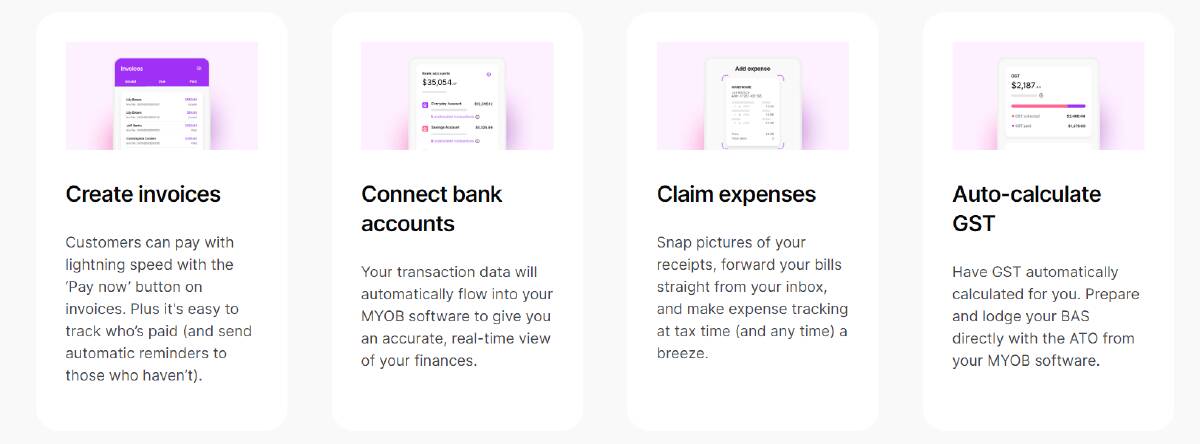

Accounting software and systems

Purchasing dependable accounting systems and software will assist you in managing your money and helping you make wise judgements. A few well-liked choices are QuickBooks, MYOB, and Xero. You can create financial reports, keep track of your spending, and manage your accounts payable and receivable with the aid of these programmes. Make sure the system you select fits both your needs and your budget.

Tax considerations

You are in charge of handling your tax responsibilities as a small business owner. This entails obtaining an Australian Business Number (ABN), paying any applicable Goods and Services Tax (GST), and filing for other taxes including Fringe Benefits Tax (FBT) and Pay As You Go (PAYG) withholding. It's critical to maintain accurate records of your income and expenses and to stay current on the most recent tax rules and regulations.

Monitoring cash flow

Any small business depends on its cash flow to survive. To make sure you have enough cash on hand to pay bills and make investments in business expansion, it's critical to monitor your financial inflows and outflows. To help you prepare ahead of time and foresee any potential deficits, think about utilising cash flow forecasting tools. To make sure you are effectively pricing your goods or services, you should also have a firm understanding of your profit margins and break-even points.

Preparing for unexpected costs

While launching a small business can be thrilling, it can also be costly. Even with a well-thought-out business plan and budget, unforeseen expenses could still happen. You can increase the likelihood that your company will survive by budgeting for these unforeseen expenses.

Conduct research

It's important to do extensive market and industry research before launching your company. This will assist you in determining possible expenses that you might not have thought of. For instance, you might need to hire a security guard or buy surveillance cameras if you're launching a retail location. You may find these expenses and account for them in your business plan and budget by researching your sector.

Generate a contingency fund

Putting money aside for unforeseen expenses is one method to be ready for them. You create a separate fund just for unforeseen costs like these and make regular payments where you can. Regular contributions to this fund are welcome, and it can be utilised to help with unforeseen expenses down the road.

Review your budget regularly

Your budget should be a living document that is reviewed regularly. This will help you identify any unexpected costs that may arise and adjust your budget accordingly. For example, if you notice that your utility bills are higher than expected, you may need to adjust your budget to account for this.

Consider insurance

Business insurance can be a valuable tool for small businesses. It can help protect you from unexpected costs, such as property damage or liability claims. Consider speaking with an insurance agent to determine the types of insurance that are appropriate for your business.

Frequently Asked Questions

What expenses are commonly incurred monthly by a small business?

Monthly expenses for small enterprises often consist of many costs. These include the cost of a business location's rent or mortgage, utilities like water and electricity, phone and internet fees, inventory or supplies, insurance, and employee salary. Additional expenditures could include those for marketing costs or advertising, software subscriptions, or equipment upkeep, depending on the type of business.

What are the typical monthly operating costs for a small business in Australia?

Depending on the business's location and industry, a small business's typical monthly running costs in Australia might vary significantly. However, $52,200, or $4,350 a month, was the average total expense for small enterprises with an annual turnover of less than $2 million, according to a survey done by the Australian Bureau of Statistics. This covers costs for things like utilities, salaries, and rent.

How much does it typically cost to register a business name in Australia?

Whether or not that organisation is registered as a company and the duration of registration determine how much it costs to register a business name in Australia. In 2023, registering a business name will set you back $37 for a company and $87 for an individual or partnership for a year. The cost of registering for three years is $222 for an individual or partnership and $87 for a firm. The most recent information about these fees can be found on the ASIC website, as they are subject to change.

What are some immediate tax deductions available for small business startup costs?

There are multiple instant tax deductions available for the initial beginning costs of small businesses. These include costs for things like legal counsel, registration fees, and expert opinions. Additionally, you might be able to deduct advertising, marketing costs, and website setup costs from your taxes. To be sure you are deducting all of your allowable expenses, it is crucial to maintain precise records of all your spending and consult a tax expert.

How can you calculate the startup costs for a new small business?

Finding all of the expenses that must be paid before a new small business can start making money is part of calculating the startup costs. This covers charges for things like inventory, equipment, attorneys' fees, and marketing. It's critical to investigate the costs related to your particular sector and area to obtain an accurate estimate. You can evaluate your startup costs with the help of a useful calculator on the business.gov.au website of the Australian government.