5 best copy trading platforms in Australia: Where to copy traders in 2024

This story may include affiliate links with ENTR Media who may be provided with compensation if you click through. ACM advises readers consider their own circumstances and needs. You should verify the nature of any product or service, and consult with the relevant regulators' website before making any decision.

This is branded content.

Copy trading is a great way to venture into the trading space, enabling people to learn strategy from experienced traders while using live funds. However, finding a worthwhile trading platform in Australia to copy other traders can be a difficult task. To simplify the process, we'll look at five brokers that many traders consider the best copy trading platforms in Australia.

Our picks for the best copy trading platforms

For those seeking the best Australian copy trading platforms, here are our top-rated options below.

- eToro Australia (zero commission copy trading platform)

- Pepperstone (broker with third-party copy trading support)

- Darwinex (platform focused exclusively on copy trading)

- Axi Trader (copy trading platform for mobile traders)

- AvaTrade (copy trading platform with fee-free leaders)

Why we picked these copy trading platforms

Throughout our reviews, we explored a variety of aspects critical to the success of an Australian copy trading platform, including fees, supported markets, platform activity, and any additional tools provided. Here are our summaries.

First on this list is eToro, a leading copy trading platform with offices across the globe, including Sydney, Australia. The broker is one of the most active copy trading platforms available. Thanks to its commitment to user satisfaction and regulatory compliance, eToro has cemented itself as one of the go-to copy trading platforms for many traders worldwide.

As eToro has local Australian offices, it is easier for Australian users to get assistance with any issues they may face. Moreover, the company is regulated by the Australian Securities and Investments Commission (ASIC), highlighting eToro's commitment to user safety and local regulations.

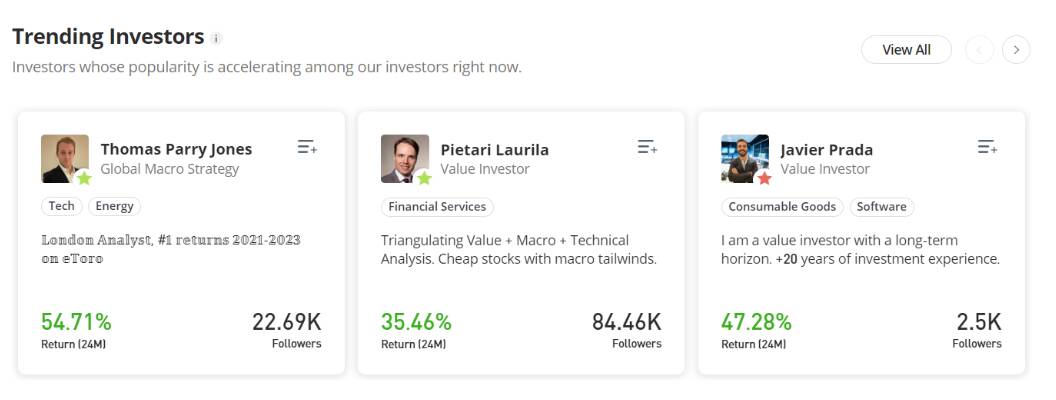

Hundreds of leaders have made their home on eToro, with some boasting over 23,000 followers. Thanks to the platform's extensive pool of knowledgeable traders, followers can browse through the copy trading platform (known as CopyTrader) to find someone aligned with their own goals, leading to greater synergy.

A significant plus to copy trading on eToro is the platform's in-depth analytics for each leader and TradingView charts. You can browse through statistics like average risk score, monthly performance, Year-To-Date (YTD) performance, win rate, and ratios of traded asset classes. With this information, eToro makes it simple to analyse potential leaders to determine which meets your criteria.

Outside of the platform's impressive copy trading system, eToro offers a demo trading account with $100,000 in virtual funds for people to sharpen their skills and practice trading. Additionally, eToro boasts a comprehensive educational platform dubbed the eToro Academy, enabling investors to learn more about copy trading and the risks involved.

eToro supports several major deposit methods in Australia. Users can deposit AUD natively via credit/debit card, PayPal, or bank transfer, meaning traders should have no issue getting money onto eToro. However, new users should know that eToro limits unverified accounts to deposit a maximum of $2,250. Click here to read an eToro review.

Fees

One of eToro's primary selling points is that it charges zero commission fees. While true, users trading Contracts for Difference (CFDs) are subject to a variable spread fee levied by eToro, a market spread, and an overnight fee. Additionally, a $5 fee is levied against withdrawals. However, there are no additional charges for copy trading.

Pros

- Highly active copy trading platform

- Australian offices and ASIC-regulated

- Free demo trading account

- In-depth analytics

Cons

- Variable fees make determining fees difficult

eToro AUS Capital Limited AFSL 491139. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. See PDS and TMD.

2 Pepperstone - Australian copy trading platform with third-party connectivity

Pepperstone is an Australian broker considered by many to be one of the best copy trading platforms in Australia. The company has been operating since 2010 and excels in its support for third-party connections like MetaTrader Signals, DupliTrade, cTrader, and AutoChartist. However, Pepperstone does not offer a propriety trading system, leading to reliance on third parties.

Being headquartered in Australia, ASIC regulates Pepperstone alongside the Financial Conduct Authority (FCA) and the Dubai Financial Services Authority (DFSA).

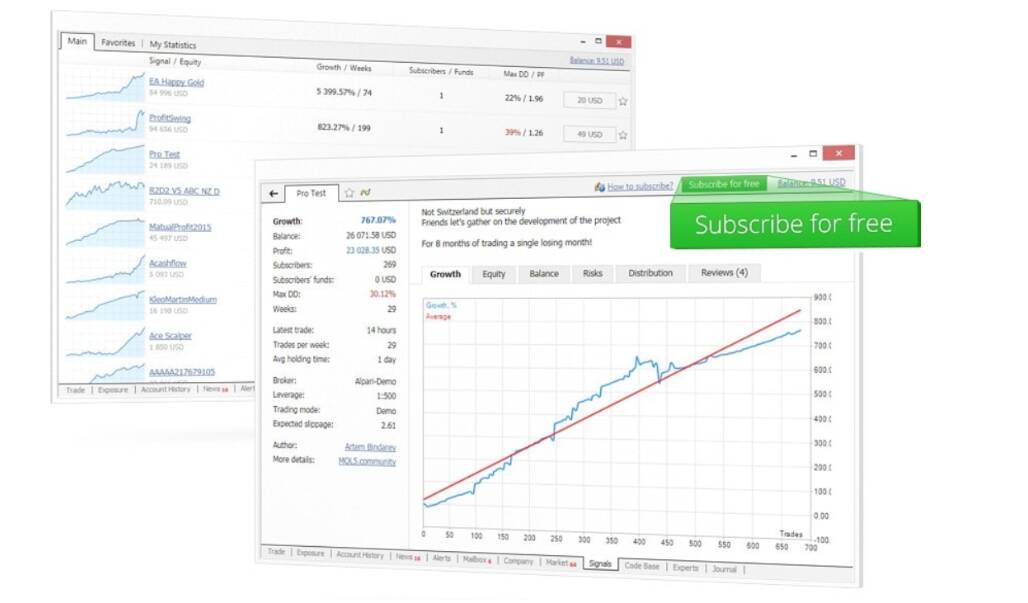

As third parties provide Pepperstone's copy trading functionality, users must link their accounts to MetaTrader Signals or DupliTrade to use the service. Thankfully, MetaTrader 4 and MetaTrader 5 are both supported for copy trading on Pepperstone, meaning users can enjoy a bit of choice.

As Pepperstone links directly to MetaTrader Signals, users can access a vast amount of data about leaders on the platform. Available data points include win/loss ratio, cumulative earnings, trading type, growth charts, balance charts, and details relating to drawdown and losses, helping users make a well-informed decision of who to follow.

Traders can connect their Pepperstone account to MetaTrader 4/5 as well as cTrader on mobile and desktop devices, so there are plenty of options when deciding your trading engine. Furthermore, through the cTrader integration, users can use the Automate platform to build trading robots and indicators.

One of the most significant benefits of using Pepperstone is its impressive range of deposit methods. The broker accepts deposits via credit/debit card, bank transfer, PayPal, Neteller, Skrill, Union Pay, and two local Australian services: POLi and BPay.

Fees

Pepperstone charges a spread fee for its standard accounts, which varies based on the instrument traded. Additionally, overnight financing and inactivity charges are also applied by Pepperstone. Copy trading fees are dictated by leaders rather than Pepperstone. MetaTrader Signals utilises monthly charges averaging around $30.

Pros

- Multiple local deposit methods

- Connects to MetaTrader Signals

- Support for lots of third-party tools

Cons

- No propriety trading system

3 Darwinex - Copy trading platform with extensive analytics

Launched in 2012, Darwinex is an innovative broker designed to empower traders through its Darwin copy trading system and its DarwinIA seed capital allocation program. The platform boasts a propriety copy trading system with impressive analytics, many different strategies, and a dedicated system for managing subscripted Darwins (copy trading strategies).

Although the UK's FCA and the Financial Services Authority (FSA) in the Seychelles regulate Darwinex, ASIC does not regulate the company. Because a local Australian regulator does not license Darwinex, citizens of the country may have limited recourse if something goes awry.

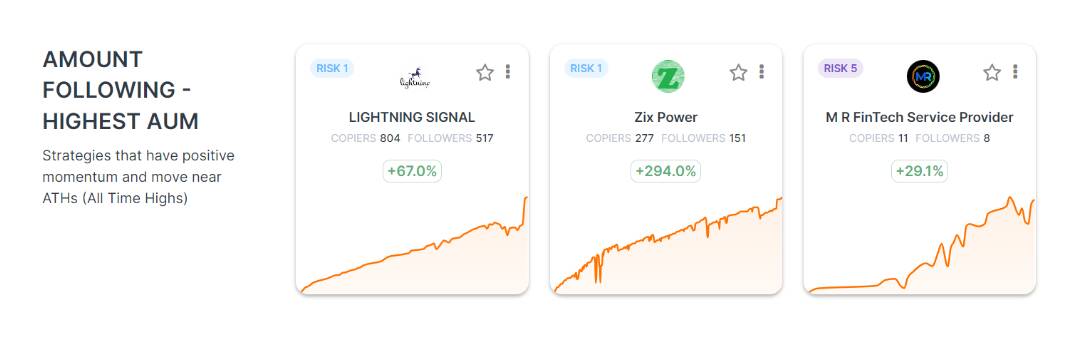

Copy trading strategies are known as "Darwins" on Darwinex. Users can browse Darawins by categories like most investors, trending, and 'returns over 50 per cent, making it straightforward for users to find Darwins relevant to them. Moreover, Darwinex includes a customisable chart that compares the performance of all Darwins in a particular category.

Its in-depth, transparent analytics are a significant reason Darwinex is considered one of Australia's best copy trading platforms. The broker clearly presents data in tables and charts, making checking a specific Darwin's historical performance simple. However, Darwinex also provides each strategy a Darwinex score, summarising its overall performance.

As Darwinex solely focuses on the activity, it's a very well-designed copy trading platform. The broker provides filters and search tools, like lists, to make finding the right Darwin easier. Additionally, Darwinex features a central hub containing all your subscribed Darwins, management fees, performance fees, and portfolio risk, making managing trades simple.

Darwinex lets users deposit funds via wire transfer, but there is a $500 minimum for the first deposit and a $100 for subsequent deposits. Darwinex also supports deposits via credit/debit card and Skrill. However, cards have a $20,000 lifetime limit, while Skrill is locked at a maximum of $5,000. Additionally, all deposits are processed in USD, which could result in extra bank fees.

Fees

Regarding fees, Darwinex charges a 20 per cent performance fee on all user-created Darwins. While 15 per cent goes to the leader, Darwinex takes the remaining 5 per cent to cover operations. For wire transfers below $2,000, charges may apply. Additionally, withdrawal fees are 100 per cent passed to the customer.

Pros

- Propriety copy trading system

- Extensive analytics

- Excellent filtering system

Cons

- Not ASIC-regulated

- No direct AUD deposits

4 Axi - Mobile-only copy trading platform

Axi is a popular broker based in Sydney, Australia. The company offers a mobile-only copy trading service, enabling users to browse and subscribe to leaders while on the go. Although the broker is accessible via the web, its copy trading service is exclusive to mobile devices.

Axi is committed to upholding regulatory requirements and is regulated by ASIC, the FCA, and DFSA. As the platform is regulated by

Highlighting its commitment to upholding regulatory requirements, Axi has gained licenses in several jurisdictions and is regulated by Australia's ASIC, the UK's FCA, and Dubai's DFSA. As such, users can be sure that Axi will always aim to adhere to local regulations.

The Axi copy trading app boasts an intuitive interface highlighting trending leaders and enabling users to manage their copy trading activities from mobile. As Axi's service is propriety, you sign into the app using your account details and do not have to connect manually to the broker.

Axi's copy trading app is simple to use but lacks depth regarding analytics. Users can view a few profitability statistics and a summary of trading history, including the win/loss ratio. Additionally, the app features pie charts indicating which markets a leader has traded.

Axi benefits from having a small minimum deposit of just $5 for credit/debit card transactions or $10 when paying via Waave. While the broker offers native AUD support, only two deposit methods are available, reducing convenience.

Fees

Axi charges a variable spread fee in addition to an overnight financing fee. Withdrawals are free above $50 or for the entire account balance, but a $25 fee may apply for other withdrawals. For copy trading, leaders set the fee amount themselves. While most users have allocated 30 per cent, some offer their copy trading services for free, which could be a pro for some people.

Pros

- Based in Australia

- Simple to use

- Minimal deposit/withdrawal requirements

Cons

- Lack of analytics depth

- Copy trading is mobile-only

5 AvaTrade - Fee-free copy trading

AvaTrade is another world-famous broker offering copy trading services via its mobile app and third-party partners. Founded in 2006, AvaTrade has a stellar track record as a regulated broker, highlighting the platform's trustworthiness. AvaTrade lets people copy trade on mobile via its AvaSocial app. However, users can connect AvaTrade to DupliTrade or ZuluTrade to access the service on desktops.

Being a licensed business, AvaTrade is regulated by several authoritative bodies, including ASIC. As such, Australian traders can feel at ease knowing AvaTrade closely follows all local financial regulations and is committed to serving Australian clients.

AvaTrade does not offer copy trading natively on its web app. Instead, users will have to download the AvaSocial app and conduct their trading activities on mobile. However, AvaTrade can be connected to leading third-party copy trading services, DupliTrade and ZuluTrade. Additionally, AvaTrade includes a selection of signals users can access directly within its web app.

The AvaSocial app offers a convenient way of copy trading with leaders divided into categories like "low drawdown' and 'free signals.' Unfortunately, however, analytics are basic, highlighting profitability, leverage, total amount of trades, and which markets have been traded. However, AvaTrade also shows the fee and number of followers while providing a chart summarising return history.

AvaTrade's range of accepted deposit methods is quite limited. Users can add funds to their accounts via credit/debit card or wire transfer. While e-payment services like Neteller and Skrill are available on AvaTrade, they're not accessible to Australian clients.

Fees

The majority of leaders on AvaSocial charge a substantial fee to followers, which is typically 30 per cent. This fee could substantially eat into any accrued returns. While some leaders have waived the fee, fewer free providers are available. AvaTrade also charges a variable spread fee, an overnight funding fee, a $50 inactivity fee after 3 months, and a $100 administration fee after 12 months.

Pros

- Can connect to third-party copy trading services

- Some fee-free leaders

- ASIC-regulated broker

Cons

- AvaSocial is not available on desktops

- Limited deposit methods

What to look for in an Australian copy trading platform

When selecting the best copy trading platform, it's critical to consider the most important factors to you personally such as your trading strategies. However, we've also broken down a few requirements of any copy trading platform worth its salt.

Trustworthiness

It may seem obvious, but ensuring an Australian copy trading platform is trustworthy and transparent is one of the most important things a prospective trader can do. It's worth checking that the company adheres to all local regulations and is correctly registered to make sure that you're dealing with a legitimate organisation.

Quantity of leaders

Copy trading platforms adhere to a leader-follower structure in which 'leaders' engage in trades while 'followers' automatically mirror them. A worthwhile Australian copy trading platform must feature a substantial selection of experienced leaders. Otherwise, followers will struggle to find traders aligned with their preferences.

Depth of information

Another easy-to-overlook aspect of leading copy trading platforms is the depth of information offered. You'll need to know statistics like trade win rate, profitability, and typical strategies to select a leader. Therefore, the best copy trading platforms in Australia will let you quickly view many analytics related to each trader.

The pros of copy trading platforms

- Knowledge and expertise are easily accessible: Those who lack the time, knowledge, or confidence to trade alone can now have greater access to the world of investment thanks to copy trading. Financial markets can now be accessed by anyone with different degrees of experience thanks to the democratisation of trade.

- You can learn from the best: Copy trading, sometimes referred to as social trading, is a teaching tool for novices. Novice investors can learn about various trading techniques, comprehend the variables driving investing decisions, and obtain insights into how markets function by studying the tactics and choices of successful traders.

- Portfolio diversification is easier: Investors can easily achieve portfolio diversification through copy trading. Investors can diversify their risk over a variety of investments by following many traders who use different tactics or specialise in different assets, potentially lessening the impact of a single underperforming deal.

- It saves your time: For many investors, conducting in-depth research and analysis can be a difficult and time-consuming task. This procedure is streamlined by copy trading, which enables anyone to benefit from the knowledge and investigation of seasoned traders. This allows investors to continue trading in the financial markets while focusing on other elements of their lives.

- It can be an automated process: A lot of copy trading systems allow trades to be executed automatically, saving investors the trouble of manually keeping an eye on markets and placing orders. Investors who like to take a hands-off approach to investing or who have busy schedules may find this automation very helpful.

- Risk management: To assist investors in safeguarding their capital, certain copy trading platforms offer risk management tools including stop-loss orders and risk controls. These characteristics can protect against unfavourable market fluctuations and lessen possible losses.

The cons of social trading platforms

- Risk of loss: Even with its advantages, copy or social trading still carries some risk of losing money. If the traders whom investors are mimicking make bad choices, suffer losses themselves, or the market conditions abruptly shift, investors could still lose money. Regardless of the trading strategy used, investors must comprehend and accept the inherent risks involved in trading.

- Dependency is high: Relying exclusively on copy or social trading could encourage reliance on other people's judgement and abilities. While it may be profitable to emulate successful traders in the short run, doing so may prevent investors from gaining the information, confidence, and abilities necessary for effective trading. With time, this reliance may make it more difficult for investors to create their investing strategies or adjust to shifting market conditions.

- Costs: For their services, a lot of copy-trading platforms demand fees or commissions. Depending on the platform, these expenses might differ greatly and could include spreads on trades, performance fees, or subscription fees. When assessing copy trading platforms, investors should pay close attention to these expenses and how they may affect their prospective returns.

- You have limited control: By putting their money in the hands of other traders, investors who copy trade give up some degree of control over their capital. Although some copy traders may find this handy, it also implies that they have less flexibility to modify their portfolio in real-time in response to shifting market conditions or personal preferences.

- There is a possibility of manipulation: In the cutthroat world of social trading, some traders might try to gain followers and boost their profile on copied trading platforms by manipulating their trades or performance. This could produce false results and put investors at more risk by allowing them to follow traders who act dishonestly or fraudulently, for example.

- Market volatility: During times of extreme market volatility, copying trades in real-time may cause slippage or delayed execution. This may affect duplicated trade performance and cause differences between copied trade performance and the performance reported by the copied trader. Investors ought to be cognisant of these possible obstacles and contemplate executing risk mitigation strategies to lessen their influence.

Frequently Asked Questions

What is copy trading?

Copy trading is a system enabling people (known as followers) to mirror the trades of others (called leaders) automatically. While followers benefit from the ability to mirror experienced traders, leaders typically earn a portion of their followers' profits, incentivising them to continue taking trades and maximise returns while effectively managing risk.

Is copy trading safe?

Although copy trading is inherently safe, many risks are involved. For example, even if you trade on the best copy-trading platforms in Australia, it's possible to lose money if a leader's trade goes awry. As such, it's critical to use a trustworthy platform and to perform ample due diligence regarding any leader whose trades you choose to mirror.

This information is general and is for educational purposes only. We do not provide financial advice nor does it take into account your financial situation. These platforms can be complex and investors should obtain professional advice from an independent financial adviser where appropriate and make your enquiries. We may receive compensation if you visit their website.