Best CFD trading platforms in Australia 2024 list

This is sponsored content by PropCompanies.

We designed our ultimate guide to the best CFD trading platforms in Australia to help you find the best brokers with the best software and tools, lowest spreads, and the most diverse range of financial instruments.

After comparing the pricing and technology of 40+ brokerages, our team came to the conclusion that the following five ASIC-regulated brokers provided the best trading platforms for Australian CFD traders.

- Eightcap - Best Australian CFD Broker Overall

- Pepperstone - Top CFD Trading Platforms

- IC Markets - Good Broker for Share CFDs

- OANDA - Best Broker for Low Spreads

- IG Group - Diverse Range of CFD Products

1. Eightcap - Best ASIC regulated CFD broker overall

Eightcap, founded in Melbourne 15 years ago, is a leading Australian forex broker known for its extensive offering which you can tailor to your own personal needs and preferences. With three account types, three trading platform options, and a collection of add-on trading tools, this broker comfortably accommodates all forex trading styles and strategies.

In total, up to 800 financial instruments can be traded with five major asset classes available. This includes over 40 forex pairs, commodities like gold and silver, indices from global stock markets, shares like Apple and Google, and over 100 crypto derivatives.

CFD Trading Accounts

Australian forex traders can choose between three account types and pricing models:

- Raw Account

- Standard Account

- TradingView Account

Raw Account

The Raw Account is an ECN-style account with ultra-tight spreads plus a round-turn commission fee. This option is ideal for those automating their trading strategies using Expert Advisers (EAs). To get a better understanding of Eightcap's competitiveness, we conducted a thorough comparative analysis of Australian forex brokers.

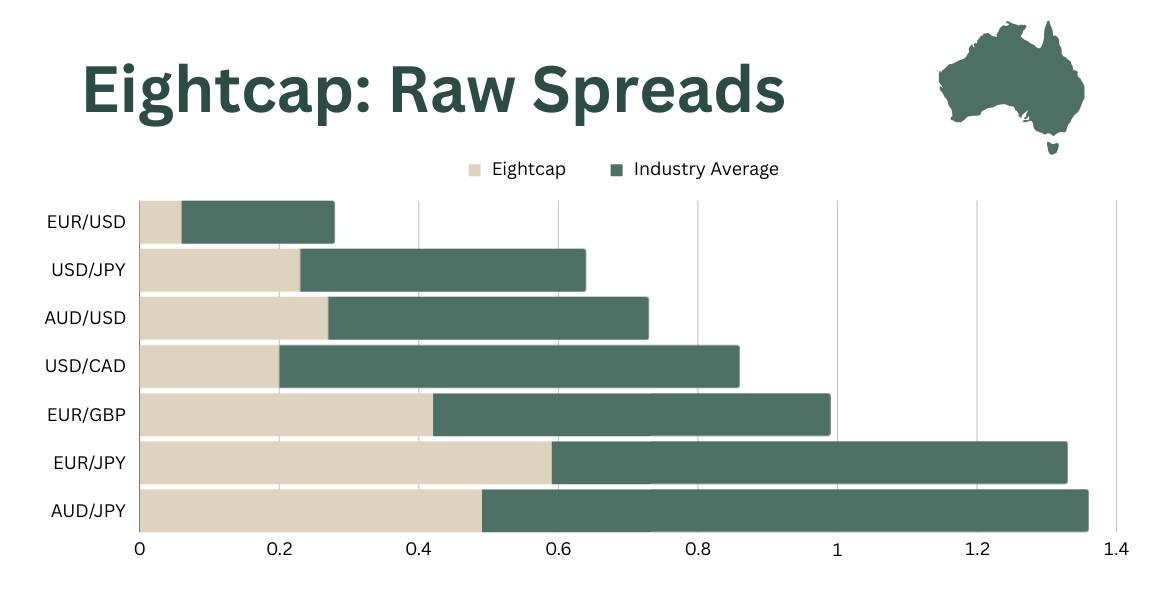

Raw Spreads

When we calculated the average spreads of major ASIC-regulated forex brokers, Eightcap's pricing stood out as among the best in the industry. While the industry average for the EUR/USD is 0.22 pips, Eightcap averages 0.06 pips.

That means Eightcap's average spreads beat the market average by over 72 per cent.

Eightcap clients also enjoy significant savings when trading the other major currency pairs. For instance, our comparative analysis showed an industry average of 0.41 pips for the USD/JPY forex pair, yet Eightcap sits around 0.23 pips. When we average the percent difference in the table below, Eightcap offers spreads 45 per cent tighter than the industry norm.

Standard Account

Looking for a simple pricing structure more than an ECN trading environment? Eightcap's Standard Account is your best option. With all-inclusive, no-commission spreads, you can focus on developing your trading strategies and skills rather than complex commission calculations.

TradingView Account

For those looking to delve into the world of social trading while gaining access to extensive trading tools, the broker's TradingView Account may be better suited.

Benefits of an Eightcap TradingView Account

- Trade CFDs with over 15 customisable charts and 90 drawing tools

- Utilise over 100,000 community-built technical indicators or build your own using the software's proprietary language, Pine-Script

- Join a global forex community where you can share ideas and CFD trading strategies

- Create custom alert conditions and notifications

- Compatible with Android and iOS devices

Account funding

All account types require a low minimum deposit of AU$100, making this broker accessible to traders on a budget. To make deposits and withdrawals, Australian traders have the option of debit and credit cards (Mastercard or Visa), e-Wallets (Skrill or Neteller), BPay, and wire transfer.

CFD trading platforms

When creating an Eightcap trading account, Australians can select MetaTrader 4, MetaTrader 5, or TradingView. While TradingView focuses on technical analysis tools and a social trading network, MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are widely known for their automated trading capabilities.

Education and resources

We asked Justin Grossbard of CompareForexBrokers, a leading voice in forex trading, to share his insights into the broker's recent release of 'Eightcap Labs'.

"The new educational suite from Eightcap Labs is a valuable resource for traders across the board. It's not just designed for beginner traders covering the basics of forex trading, it offers comprehensive lessons and detailed analysis from seasoned industry professionals for those wanting to take their trading strategies to the next level, including in-depth looks at intricate trading strategies and approaches to fundamental analysis.

Regardless of your trading experience, Eightcap Labs will help traders elevate their skills and navigate the complexities of foreign exchange."

As well as educational resources, the CFD broker's in-house experts also provide commentary on global markets and the economic environment via their online 'Trade Zone' area.

To supplement the education and research tools, Eightcap allows you to experiment with trading using virtual money. Demo accounts remain active for either 30 days or 5000 orders, so you can make the switch to live trading confident that you've chosen the right broker for your needs. If you have an active trading account, the 30-day limit does not apply, and you can maintain your demo account for educational purposes as long as you wish.

ASIC regulation

As with all brokers included in our forex broker guide, Eightcap is regulated by ASIC and holds an Australian Financial Services License (AFSL No. 391441).

Eightcap Overall

- Tailored trading with three account types and trading platforms

- Over 800+ financial instruments across five asset classes

- Competitive low spreads below the industry average

2. Pepperstone - Best CFD trading platform and tools

Pepperstone is arguably the most well-known Australian forex broker thanks to its selection of trading platforms, low spreads, top-tier liquidity sources, and range of financial markets available to trade as CFDs.

Retail traders have the choice between a no-commission standard account for beginners or an ECN-style Razor Account for high-volume traders.

Trading platforms

Pepperstone offers the three most popular third-party trading platforms worldwide: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, along with a newly released proprietary platform.

Each platform offers an excellent online trading experience, however each caters to slightly different needs. For instance, MetaTrader 4 and cTrader are ideal if you want to focus on forex markets, while MetaTrader 5 is a good fit if you are looking to diversify your currency trading strategies with stock markets or ETFs.

Pepperstone's new proprietary software has only just been released and provides access to a diverse range of CFDs, including forex, commodities, indices, and cryptocurrencies.

Meta Trader 4

MT4 is the most popular trading platform worldwide used to access foreign exchange markets. We've asked forex tech expert Noam Korbl from CompareForexBrokers to give us an overview of the trading platform.

"This platform has long been the go-to choice for forex traders globally, and it's easy to see why. Having been my preferred trading platform for years now, MT4 stands out for its advanced automated trading features enabled by Expert Advisors, along with a comprehensive charting package and user-friendly interface.

The MT4 charting tools provide everything you need for sophisticated technical analysis, while the EAs eliminate the need for time-consuming manual trading. Its popularity over the years is a testament to its ability to stay reliable and up-to-date, providing retail traders with everything they need for a successful trading experience".

MetaTrader 5

A multi-asset platform with a wider range of in-built charting tools, MT5 goes one step further than its predecessor. While MT4 is predominately for foreign exchange trading, MT5 provides access to products traded on centralised exchanges, such as stocks.

As well as access to a greater number of assets, you also have a greater number of timeframes, technical indicators and drawing tools when compared to MT4.

MT4 and MT5 Trading Tools

Pepperstone forex traders can expand their MT4 tools even further with the broker's Smart Trader Tools. The additional Expert Advisor tools are complimentary for MT4 and MT5 users and provide automated trading tools such as a Correlation Matrix, Trade Terminal and Smart Lines.

Additionally, Pepperstone MT4 and MT5 traders can also utilise Autochartist for automated market scanning and analysis. Both MT4 and MT5 are available as desktop apps, webtrader platforms, and trading apps for Android and iOS devices.

cTrader

cTrader is a trading platform well-suited to more experienced forex traders seeking an institutional-like trading environment via the broker's Razor Account.

Pepperstone's cTrader features include:

- Advanced order management

- Customisable interface and chart layouts

- Sophisticated technical analysis tools

- C# coding language and open API

- Automated trading via cTrader Automate

- Multiple order types for risk management

- Desktop app or mobile apps or iOS and Android

Pepperstone also offers TradingView as an integration to cTrader. With over 30,000,000 traders, advanced trading tools, and a user-friendly proprietary language, you can turbocharge your forex trading experience using a combination of cTrader, TradingView, and Pepperstone's Razor account.

Pepperstone proprietary trading platform

Pepperstone's proprietary trading platform is a recent addition to the broker's toolkit. Designed by forex traders, the platform provides a user-friendly mobile app and Webtrader with a customisable interface. It also features advanced technical indicators and charting tools, plus risk management tools to protect yourself against volatility.

Other trading tools

Pepperstone also offers various third-party software and add-ons to enhance your trading experience. These include MetaTrader Signals and DupliTrade for copy trading and Capitalise.ai for code-free algorithmic trading.

Regulatory oversight

Pepperstone is a Melbourne-based broker which holds a valid AFSL (License Number 414530).

Pepperstone overall

- The choice of the three most popular trading platforms - MT4, MT5, or cTrader

- Advanced trading tools and add-on packages for each trading platform

- Excellent trading conditions with ECN-style pricing, fast execution, and top-tier liquidity sources

3. IC Markets - Best broker for share trading

IC Markets is a Sydney-based broker known for its ultra-low spreads, fast execution, and CFD and share trading offerings.

Share trading

IC Markets has recently launched a new venture that allows Australian residents to diversify their share trading activities. Now, you can engage in both short-term speculation via share CFDs, as well as longer-term investments trading actual shares.

Their 'Share Investing' portal grants you access to over 2,200 Australian shares where you can buy, sell, and hold the underlying asset (rather than trading a derivative product like with CFDs). When trading stocks, you pay a flat-rate fee of AU$7.70 for lots up to 100k.

Justin Grossbard from CompareForexBrokers.com elaborates on IC Markets' new offering.

"IC Markets expansion into physical equity investment is a major move. Their clients now have the opportunity to trade CFDs as well as shares of mid-cap and blue-chip companies listed on the Australian Securities Exchange (ASX). There's few Australian brokers that offer such a diverse and user-friendly trading experience, proving IC Markets continues to be ahead of the game for client experience".

In terms of single stock CFDs, IC Markets offers thousands of shares listed on Australian and American stock exchanges as Contracts for Difference.

As well as CFD share trading, IC Markets traders can develop strategies involving commodities, indices, bonds, cryptocurrencies, and forex.

Trading platforms

IC Markets offers MT4, MT5, or cTrader as trading platform options. Additional add-ons are available with MetaTrader platforms, including Autochartist and a suite of 20 advanced trading Tools. All three platforms are available as desktop platforms and trading apps, with MT4 and MT5 also accessible via Webtrader online.

Trading costs

IC Markets offers two account types: a Standard Account with no commission fees and a Raw Account with ECN-like spreads.

If you are trading forex CFDs via the broker's Raw Spread Account, you can access spreads as low as 0.0 pips. You pay low commission fees of AU$6 roundturn on cTrader and AU$7 MetaTrader platforms (per USD 100k traded).

On the other hand, the Standard Account gives you access to low spreads with no commission fees. When testing each broker, we found IC Markets' minimum spreads to be very competitive, starting at 0.6 pips for AUD/USD and 0.8 pips for major pairs like the EUR/USD and GBP/USD.

To open a live trading account with IC Markets, a $ 200 minimum deposit is required. The majority of the CFD broker's methods involve no deposit and withdrawal fees, with credit card, bank transfer, and e-wallet payment methods available.

General admin fees apply to all account types, including overnight financing fees and inactivity fees. Yet, IC Markets' account and trading costs are generally very competitive.

Regulatory oversight

IC Markets is ASIC-regulated and registered under International Capital Markets Pty Ltd in Australia (License Number 335692).

IC markets overall

- CFD and share trading

- Access to a wide range of financial markets

- Competitive spreads and low trading costs

4. OANDA Corporation - Best broker for low spreads

OANDA Corporation is a US-based CFD broker globally recognised for their ultra-low spreads. In terms of trading platforms, you have the choice of their proprietary OANDA Trade platform, MetaTrader 4, and TradingView.

OANDA offers two account types for CFD trading. While the Core Account offers minimum spreads of 0.1 pips plus AU$7 roundturn commission fees (per 100k lot), the commission-free, Spread-only Account is this broker's real strength.

Competitive Spreads with No Commission

When we tested each broker's commission-free pricing, OANDA was the clear standout, with minimum spreads over 50 per cent lower than the industry average.

As shown in the table below, this competitive edge continues across all major currency pairs, with OANDA's spreads beating the industry average by up to 61 per cent.

As well as competitive spreads, both OANDA trading accounts offer the following benefits:

- CFDs on forex, indices, bonds, commodities, and cryptocurrencies like Bitcoin

- No initial minimum deposit requirement

- Dedicated relationship manager and 24/5 customer support

- Technical analysis and charting tools

- Market data coverage and real-time news

- Customisable interface and mobile apps for all trading platform options

- Guaranteed stop-loss orders (OANDA Trade only)

- MetaTrader 4 premium upgrade for an additional suite of trading tools

MetaTrader 4

While OANDA allows you to choose between MT4, OANDA Trade, and TradingView, our research found that the MetaTrader 4 offering is the strongest. The platform fully supports automated trading, which means you can build trading algorithms, backtest strategies, and purchase other traders' bots in the MetaTrader Marketplace.

The MT4 premium upgrade is also a massive perk, as you gain access to additional technical indicators and Expert Advisors to develop and manage your trades.

Regulatory oversight

OANDA is regulated in multiple jurisdictions worldwide, including ASIC in Australia, the FCA in the UK, and NFA/CFTC in the United States.

OANDA overall

- Competitive spreads from 0.6 pips commission-free

- The choice of MT4, OANDA Trade, and TradingView

- Premium upgrade for MetaTrader 4

5. IG Trading - Broker with diverse CFD products

IG Trading has a long-standing reputation for offering one of the best selections of CFDs worldwide. With over 17,000 financial markets to choose from, you'll find something for every style of trading.

Financial markets

As an IG trader, you gain access to a phenomenal 17,000 financial markets with both CFD and Over the Counter (OTC) trading available.

If your focus is foreign exchange markets, 80 major, minor, and exotic currency pairs are on offer. As well as forex, you can trade stock, index, and commodity CFDs, along with more obscure cryptocurrencies and instruments like interest rates, sectors, bonds, and Digital 100s.

Trading platforms

To supplement its diverse range of financial products, IG offers four major trading platforms suited to different levels of trading experience.

- MetaTrader 4: Automated trading with Expert Advisers, with access to index, crypto, commodity, and forex markets. Desktop, webtrader, and trading apps available.

- IG Proprietary Platform: Available as an online trading platform or mobile app for Android and iOS devices. Provides access to Autochartist for technical analysis and the broker's full CFD range.

- ProRealTime: For more experienced traders looking for advanced charting tools. The software is free for high-volume traders. Otherwise, a significant monthly fee of AU$40 applies.

L2 Dealer: Provides both CFD and share trading via a desktop interface. You can trade Direct Market Access (DMA) forex and shares, as well as OTC shares, indices, commodities and forex.

Reputation and regulation

Since its establishment in London in 1974, the broker has won countless industry awards, including recognition for its proprietary trading app and online trading services. With thousands of five-star reviews on TrustPilot, 50 years of experience, and over 320,000 clients globally, IG is a great option for Australian traders.

IG Australia Pty Ltd is regulated by ASIC in Australia (ASFL 515106), yet the broker holds licences in a number of jurisdictions such as Europe (CySEC) and Singapore (MAS).

IG overall

- Access to over 17,000 different financial instruments

- Four major trading platforms catering to all levels of trading experience

- Award-winning broker with a long-standing reputation

What is the best platform for CFD trading?

The best CFD trading platform for Australian traders depends on your trading style, experience, and the financial market that interests you. If you plan to focus on foreign exchange markets, MetaTrader 4 or cTrader may be best suited. If your trading strategies involve exchange-traded products, you will need to look at MetaTrader 5 or a broker's proprietary platform.

Brokers like Eightcap, Pepperstone, and IC Markets all offer a combination of trading platforms with various pricing structures to suit a wide range of traders.

To learn more, you can read about The Best Forex Trading Platforms in Australia or take a deeper look at The Best Forex Brokers in Australia.

Alternatively, if you are in New Zealand, you can learn more about The Best FMA Regulated Brokers or The Lowest Spread Brokers in NZ.

What is CFD trading?

Contracts for difference (CFD) trading is where you speculate on the price movements of assets without owning them. Key features include high leverage, access to global markets, and the ability to go long (buy) or short (sell). However, due to the high leverage and volatility of certain markets like cryptocurrencies and forex, CFD trading involves a high risk of losing money.

How do I trade CFDs in Australia?

To get started trading forex CFDs, you'll need to select a broker that offers your desired account type, trading platform, and financial markets. In our guide below, we outline the key strengths of four of the best brokers operating in Australia, all of which are regulated by the Australian Securities and Investments Commission (ASIC).

We always recommend that Australian traders open accounts with ASIC-regulated brokers to ensure the safety of their funds. Additionally, it is vital to read all Product Disclosure Statements (PDS), disclaimers, and risk warnings before you start trading.

Is Forex trading legal in Australia?

Yes, forex trading is legal in Australia. Forex brokers and online trading is regulated by the Australian Securities and Investments Commission with the regulatory body setting the rules around leverage, account management, and risk warnings for CFD brokers and retail investors.

Disclaimer: CFD trading comes with a high risk of losing money. Always read the PDS and risk warnings before you start trading. We always recommend trading with a broker regulated in your local jurisdiction.

Disclaimer: This story may include affiliate links with PropCompanies partners who may be provided with compensation if you click through. ACM advises readers consider their own circumstances and needs. You should verify the nature of any product or service, and consult with the relevant regulators' website before making any decision.