eToro review Australia: Features, fees, and usability

This is branded content.

eToro is a popular broker allowing users to trade forex, stocks, and commodities with zero commission.

Throughout this eToro Australia review, we'll look at the broker's features, fees, and overall performance so our readers can see whether it fulfills their requirements.

Disclaimer: This information is general and is for educational purposes only. We do not provide financial advice nor does it take into account your financial situation. These platforms can be complex and investors should obtain professional advice from an independent financial advisor where appropriate and make your enquiries. ENTR Media may receive compensation if you visit their website.

What we thought of eToro

eToro offers a mixture of tools catering to a wide spectrum of investors and traders. From its copy trading functionality to its support for Contract-for-Difference (CFD) leverage trading, the top-rated Australian trading platform has been designed to appeal to a broad audience. While working out spread fees on the commission-free broker can be challenging, eToro's range of tools makes it suitable for many trading styles.

Pros

- Although eToro charges a spread fee, the broker doesn't levy a direct trading fee, making it more cost-effective for traders.

- eToro's CopyTrader can help new traders gain experience with the market while also assisting profitable traders to earn additional, consistent income.

- As a multi-asset class broker, eToro boasts over 5,000 tradable assets across several markets, so there are plenty of opportunities on the platform.

Cons

- As spread fees vary from asset to asset, they can be challenging to account for ahead of a trade.

- eToro uses USD as its platform currency, meaning non-USD deposits will be charged a USD conversion fee.

eToro features available to Australians

For our eToro Australia review, we'll explore a few of the platform's most notable features.

Fractional shares

eToro lets you purchase a fraction of a stock or Exchange Traded Fund (ETF) as long as it's above the minimum investment amount. Although eToro lets you buy a fraction of a stock or ETF, the assets are only supported by the broker, making them illiquid and untradable outside of eToro.

That said, the ability to purchase a fraction of a share makes it possible to build a well-diversified portfolio gradually.

CopyTrader

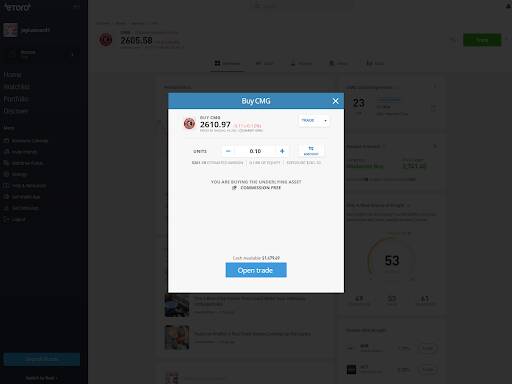

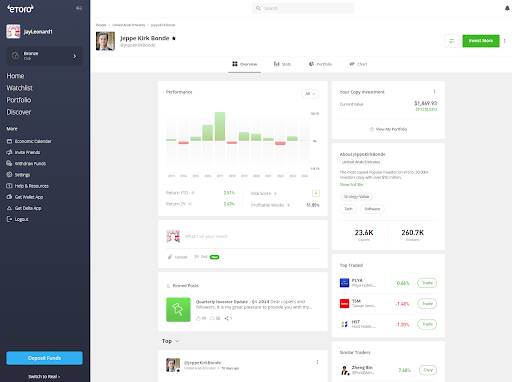

eToro has built its social trading tool, dubbed CopyTrader, which is essentially a copy trading platform. From what we could tell, the system lets traders known as "followers" automatically mirror the trades of experienced investors dubbed "leaders."

As such, eToro CopyTrader enables you to learn proper risk management and strategy from people who have actively traded for years.

While the tool lets you trade by copying, it also benefits leaders as they can earn consistent income from the program, the most notable being 1.5% of Assets Under Copy (AUC), paid every month.

eToro Academy

For people in Australia wanting to learn how to trade stocks and CFDs, eToro has a comprehensive educational platform named eToro Academy.

The platform contains a plethora of articles covering basic topics like the basics of using the broker to stock analysis and trading guides.

The content hosted in the eToro Academy comprises informative video guides and extensively written articles featuring images, tips, and comparative tables.

Articles on the Academy platform are well-written and explain the ins and outs of most of eToro's features, tools, and services. Worthwhile checking out if you want to learn how to trade.

Demo account

On top of its live trading features, eToro has a demo account with virtual funds. The broker provides $100,000 in virtual funds to trade leveraged CFDs, stocks, commodities, currencies, and more.

eToro's demo accounts also work in conjunction with the CopyTrader system, enabling users to allocate funds to mirror a particular leader.

As such, eToro has made it possible to test various leaders to see which yields the best mixture of profits and risk management without the possibility of losing real money.

What deposit methods are available to get started?

The broker natively supports AUD deposits via bank transfers, credit/debit cards, and PayPal, but as the platform operates in USD a conversion fee will be applied for AUD deposits. It's important to note that users can only conduct $2,250 worth of transactions before they must verify their account.

What assets can be traded?

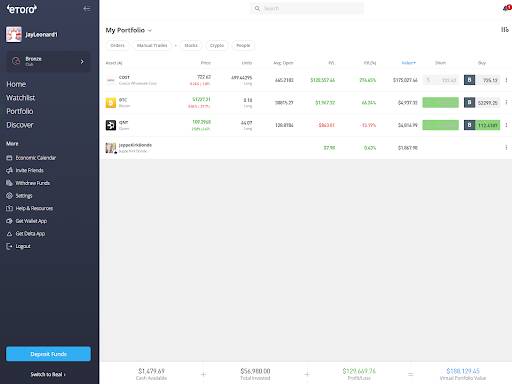

As eToro operates worldwide, Australian citizens can use the broker to purchase shares in Australian and international companies/funds, vastly increasing the number of tradable assets on the platform.

Between all of the broker's supported asset classes, eToro offers over 5,000 tradable assets at the time of writing.

eToro's fees to trade

One of eToro's highlights is its commission-free nature; you can spot-trade all assets without paying a commission.

However, eToro applies a variable spread fee (difference between buy/sell prices) to all trades and a variable commission against short or leveraged positions. No additional fees apply to eToro's CopyTrading system.

On top of the spread fees, eToro charges a $5 fee for withdrawals ($30 minimum) and a $10 monthly inactivity fee if the account has not been logged into for over 12 months. Spreads for CFD trading vary based on asset class:

- Currencies - From 1 PIP

- Commodities - From 2 PIPs

- Indices - From 0.75 Basis Points

- Stocks/ETFs - 0.15%

eToro ease of use

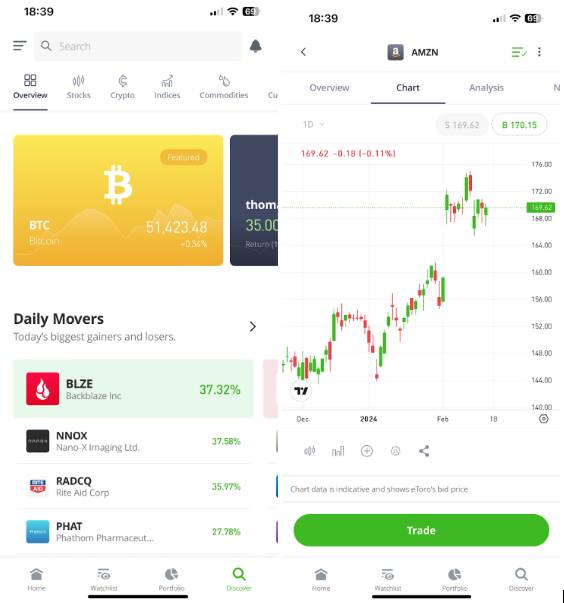

eToro has an easy-to-navigate interface that enables you to quickly find critical features, like their portfolio, the search bar, and the deposit system, reducing time spent getting to grips with the platform's layout.

Trading shares and other assets on eToro's user interface is straightforward and intuitive.

The broker displays trending assets on its homepage, simplifying finding an opportunity. You can search for a specific ticker or use the "Discover" tab to explore the top instruments from various asset classes and recently added and popular instruments.

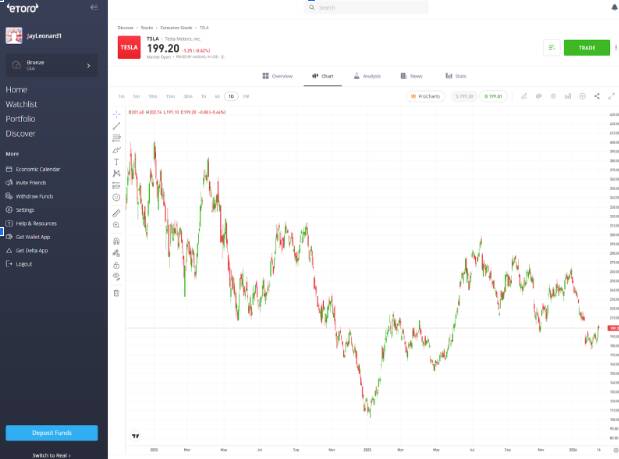

eToro has integrated TradingView into its charting software, meaning those with previous trading experience will be able to get up and running quickly.

eToro's charting system includes many technical indicators and extensive drawing tools, including premade patterns. As such, you will have access to plenty of tools for performing detailed analysis and strategy planning.

Outside of its charting system, eToro provides some tools for fundamental analysis, including an asset-specific newsfeed, research information, and company statistics. However, the newsfeed and research are only available with a funded account, reducing accessibility.

Mobile app

eToro has a mobile app that is available on Android and iOS devices. The app is well-designed and supports the majority of features present on the platform's desktop version. According to the App Store, most users agree the eToro app works well, with it receiving an average rating of 3.8/5 based on over 8,500 ratings.

After logging into the eToro mobile app, you are shown a homepage containing a user newsfeed and a few trending assets.

While the Academy and deposits/withdrawals sections are hidden behind a minimized hamburger menu, the watchlist, portfolio, and discover sections are accessible via the navigation bar, enabling users to find critical areas quickly.

The eToro mobile app boasts the same features as the desktop platform. You can trade multiple asset classes, utilize leverage, track assets, and perform detailed analysis via TradingView's charting system. The app also supports CopyTrader, demo accounts, and the eToro Academy, making it a valuable tool for learning Australians learning to trade.

eToro customer support

To ensure that you can get help with any queries, eToro has created an AI chatbot and a help center containing many articles explaining many common topics and issues.

However, if you require more tailored assistance, there's the option to speak to an advisor over live chat or open an email ticket.

While eToro does offer WhatsApp support, you need to be an eToro Club member to receive a dedicated account manager.

Additionally, we tested the live chat response time and found that advisors are only available between 8:00 AM and 8:00 PM EST between Monday and Friday. Therefore, Australians may find it challenging to be online when support from an advisor is available.

Frequently Asked Questions

Does eToro pay dividends?

Yes, you can earn dividends on eToro. If you have purchased a dividend-baring stock, eToro will automatically credit or debit your account in line with yield. The broker also withholds a 30% tax rate on dividends paid by a US corporation.

Is eToro regulated in Australia?

eToro is regulated in several jurisdictions by leading authoritative bodies. ASIC in Australia, the Cyprus Securities and Exchange Commission in Europe, the Financial Conduct Authority in the UK, and the Seychelles Financial Services Authority for international customers.

Does eToro charge fees?

eToro is a commission-free broker, meaning it doesn't directly charge a fee for trades. However, the platform does charge a spread fee (the price difference between buying and selling an asset), which varies from asset to asset.

Final verdict

eToro is a well-rounded broker with something for everyone. The broker contains thousands of tradable assets across several markets, meaning there are ample opportunities to find them on the platform.

Moreover, eToro's TradingView integration makes the platform suitable for performing in-depth analysis on mobile and desktop.

While it's unfortunate that eToro charges a conversion fee for non-USD deposits, the broker's commission-free structure and tight spreads alleviate some of the cost.

Concluding our eToro Australia review, the broker is a jack-of-all-trades suited to new and experienced traders alike.