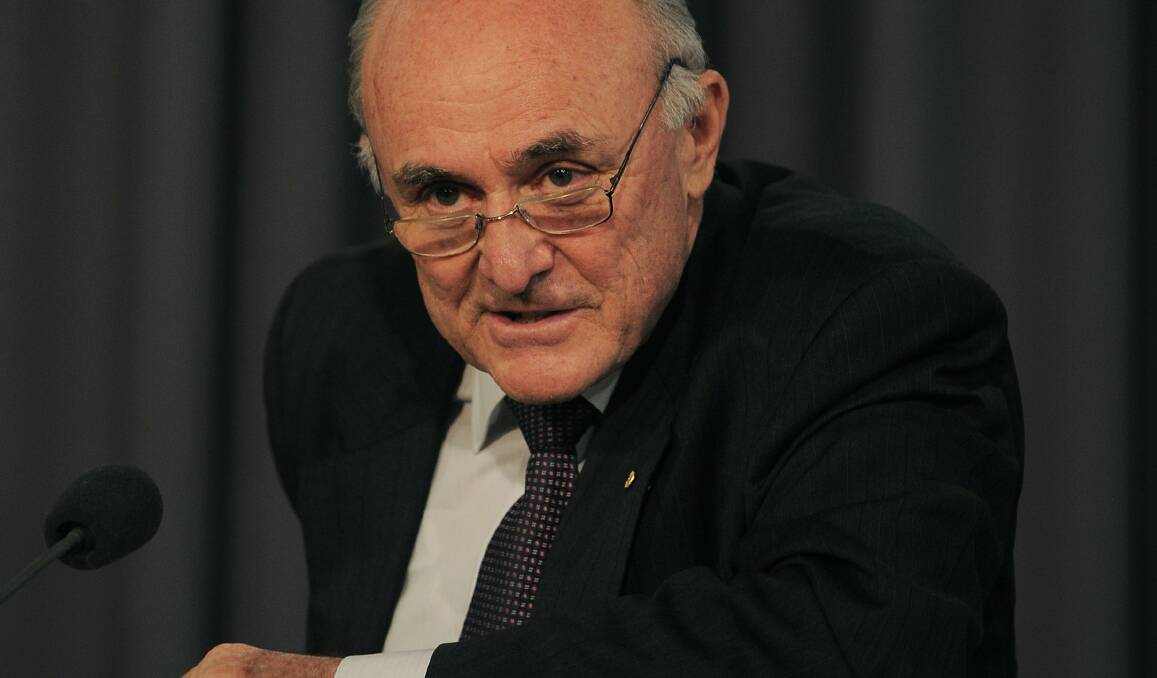

Companies that abuse their market power could be forced to sell off investments or business interests under law changes proposal by former competition watchdog Allan Fels.

Subscribe now for unlimited access.

$0/

(min cost $0)

or signup to continue reading

Professor Fels has told a parliamentary committee inquiry into economic dynamism and competition that businesses that engage in predatory pricing, withholding of supply or other conduct that abuses their market dominance should face the risk of being forced to offload valuable assets.

The economist, who led the Australian Competition and Consumer Commission between 1995 and 2003, said that although the sanction was unlikely to be used very often it would provide the competition watchdog with significant extra clout in cracking down on corporations that abuse their power.

"There should be a divestiture of power in the law," Professor Fels said, arguing it would improve compliance with section 46 of the Competition and Consumer Act prohibiting the abuse of market power.

"The fact is that section 46 doesn't have many teeth. [But] if there is just a slight possibility of a divestiture, that will get far better compliance," he said.

Professor Fels also called for mandatory notification of mergers and a change in the wording of rules to prohibit mergers that create or add to a substantial degree of power in a market.

READ MORE:

He said these words would be in addition to the existing ban on mergers proved to substantially lessen competition.

The former ACCC chair made his suggestions to a hearing of the House of Representatives Economics Committee, which is holding an inquiry into how to promote competition and dynamism into the economy.

The inquiry was launched in February amid mounting concerns about growing market concentration and its effects on the Australian economy, including higher consumer prices and lower wages.

Recent research, including by Treasury official Jonathan Hambur, has found evidence of increasing market dominance in Australia, and that this has been associated with weaker wage growth and slower productivity.

Committee chair, Labor MP Daniel Mulino, said a decline in competition in Australia was "broadly empirically established" with a likely causal link to "a decline in productivity, less innovation and the impact that has on wages".

The hearing follows a call by current ACCC chair Gina Cass-Gottlieb for an overhaul of the nation's merger regime.

Ms Cass-Gottlieb told the National Press Club last month that the rules to regulate merger were "no long fit for purpose".

Under current rules, companies are not required to inform the ACCC of a proposed merger or acquisition and can complete it without waiting to get clearance from the regulator. Furthermore, in instances where such a move is deemed to be anti-competitive, the only option open to the ACCC if it is not voluntarily abandoned is to launch legal action.

Ms Cass-Gottlieb said businesses were increasingly "pushing the boundaries" of this informal regime, providing information that was late, incomplete or incorrect and pushing ahead with a merger before the ACCC's review was complete.

Professor Fels echoed the ACCC chair's concerns and said Australia should copy other jurisdictions like the United States and the European Union to make it mandatory to notify of a proposed merger.

The economist added that the burden of proof should be switched so that those wanting a merger have to establish it would not create or add a substantial degree of market power rather than, as is currently the case, asking the ACCC to prove it would substantially lessen competition.

The Treasurer is considering ACCC proposals to reform the merger regime.