The best Forex Trading apps Australia: 2024 guide

This is sponsored content by PropCompanies.

In my analysis of over 40 brokers for the best forex trading apps in Australia, I found that some stand out with features like significantly lower spreads and faster execution speeds, enhancing your trading experience. Additionally, all CFD brokers in this guide are registered with the Australian Securities and Investment Commission (ASIC) to ensure they meet regulatory standards in Australia.

- Eightcap - Best Forex Trading Apps Overall

- Pepperstone - Best Proprietary Trading App

- OANDA - Best Forex Broker for Low Spreads

- IC Markets - Best Apps for Share CFDs

- FP Markets - Top Broker for MetaTrader 4

- IG Trading - Largest Broker for CFD Trading

- Plus500 - Best Demo Account for Beginners

- eToro - Popular Copy Trading App

To find out more about ASIC-regulated brokers, you can find further reading here about The Best Forex Brokers, The Best CFD Trading Platforms, and The Best Forex Trading Platforms in Australia.

1. Eightcap - Best Australian Forex Broker and trading apps

Since its inception in 2009 in Australia, I've watched Eightcap grow into a highly respected forex broker with a broad international reach. Their industry recognition, highlighted by the Broker of the Year award at the Global Forex Awards last year, speaks to their commitment to excellence.

In my view, Eightcap stands out for its exceptional mobile trading experience, which is among the best worldwide. They've managed to balance user-friendly interfaces and efficient trading solutions, making them a popular choice for traders globally.

Trading platforms and apps

A key aspect of Eightcap's service is its strong mobile trading offering, which includes the MetaTrader 4, MetaTrader 5, and TradingView platforms.

All platform options are available as mobile apps for Android and iOS devices, as well as desktop and webtrader platforms. You can download Android apps from the Google Store, while iOS apps for iPhones and iPads are available at the Apple Store.

In my experience, MetaTrader 4 (MT4) stands out for its user-friendly interface and extensive technical analysis capabilities. It's incredibly flexible, offering up to six types of pending orders and market execution, which I find adaptable to various trading styles.

The automated trading feature of MT4, which utilises Expert Advisors (EAs) to open and close positions on your behalf, removes the need for manual trading and is among the platform's most popular features. You can also take advantage of numerous technical analysis tools, such as 30 built-in indicators, 2,000 free custom indicators, and over 700 paid ones.

MetaTrader 5 (MT5) builds on MT4's strengths, offering more advanced charting tools and additional timeframes. Its EAs support both automated trading and analytical operations. The capacity to open up to 100 charts simultaneously, along with over 80 built-in technical indicators, positions MT5 as a sophisticated choice for detailed market analysis. MT5 also includes an economic calendar, aiding traders in staying informed about market trends.

Choosing between MT4 and MT5 largely depends on your trading preferences. MT4 is ideal for decentralised markets such as forex and commodities. At the same time, MT5 offers a more expansive reach, including centralised assets like shares. This access means you can broaden your portfolio to include more financial markets.

TradingView stands apart for its advanced charting and vibrant social trading community. It provides over 15 customisable chart types, including Kagi, Renko, and Point & Figure and can manage up to eight charts per tab. The platform's extensive range of technical and community-built indicators, exceeding 100,000, offers a comprehensive toolkit for traders. Creating custom indicators using Pine-Script language is especially useful for customising trading strategies.

Mobile Trading Tools

Eightcap's mobile apps offer a range of tools and features that enhance the trading experience:

Charting Tools: All trading apps provide various charting options, allowing traders to analyse market trends and patterns effectively.

Technical and Fundamental Analysis Tools: These tools help you make informed decisions by analysing market dynamics and economic indicators.

Automated Trading Tools: Available on MT4 and MT5, these tools enable you to automate your trading strategies using EAs.

Risk Management Tools: Essential for managing and mitigating risks associated with trading forex and CFDs.

Alerts and Notifications: You can set up alerts for price levels, indicators, and custom conditions, ensuring you stay informed of market movements.

These mobile trading capabilities ensure you can trade efficiently and effectively, regardless of your location.

Other Trading Tools

Eightcap provides a suite of advanced trading tools to enhance your trading experience. Their AI-powered Economic Calendar, for instance, offers an in-depth analysis of over 1000 global economic events from more than 100 countries, providing market impact insights and sentiment analysis that are useful for tailoring your trading strategies.

I also appreciate Capitalise.ai for its user-friendliness in automating trading strategies. It allows you to create and execute strategies supported by backtesting and real-time updates. FlashTrader, developed in collaboration with BKForex, is another tool I've found beneficial for automated risk management, enabling dynamic adjustments in trading strategies. For weekly expert analyses of economic trends and events, the Trade Zone is a go-to resource. Led by seasoned market analysts, it offers comprehensive insights.

Additionally, Eightcap Labs has been a valuable educational resource hub for me, providing essential trading knowledge, strategies, and market insights, which are instrumental in refining trading approaches. Each of these tools at Eightcap adds a unique dimension to the trading experience, covering various aspects of market analysis, strategy development, and risk management.

Accounts and pricing

Eightcap offers two main types of accounts:

Raw Account: Ideal for experienced traders, offering spreads as low as 0.0 pips with a commission of $3.5 per lot. This account type is tailored for traders who prefer trading forex CFDs and are experienced in managing spreads and commissions.

Standard Account: Suitable for beginners, offering commission-free trading with spreads starting from 1.0 pip. This simpler pricing structure suits beginners or those who prefer a straightforward trading experience without commissions.

Both accounts require a minimum deposit of $100. Eightcap provides a variety of deposit and withdrawal methods to suit different needs. These include debit cards, credit cards, Skrill, Neteller, Poli, bank transfers, and crypto wallets.

Financial Markets

Traders at Eightcap have access to a diverse range of financial markets, including CFDs on forex, cryptocurrencies, shares, indices, and commodities.

Why I Like Eightcap

I've found Eightcap really stands out for its mobile trading apps on iOS and Android, covering MetaTrader 4, MetaTrader 5, and TradingView. The automated trading with Expert Advisers on MT4 and MT5 is a big plus. Also, their Raw and Standard account options are great, as they suit both new and experienced traders well.

2. Pepperstone - Best Proprietary Trading App

Founded in 2010 in Melbourne, Pepperstone has rapidly grown into one of the world's leading forex brokers, renowned for its superior technology, low-cost spreads, and award-winning customer support. With a focus on providing user-friendly, efficient trading platforms, Pepperstone caters to traders globally, offering a seamless trading experience that combines innovative technology with tailored support, particularly benefiting Australian traders.

Trading Platform Options

Pepperstone offers diverse trading platforms, including a proprietary platform, MetaTrader 4, MetaTrader 5, cTrader, and TradingView, each tailored to different trading needs and styles.

MetaTrader 4 is suited to forex traders who need a reliable, user-friendly platform with a wide range of technical analysis tools. It's ideal for beginners and experienced traders focusing on forex and CFD trading.

MetaTrader 5 is designed for traders seeking access to a wider range of financial markets, including centralised exchanges. It offers advanced trading tools and is well-suited for traders who engage in multi-asset trading.

cTrader appeals to traders who require a more sophisticated interface with advanced charting tools, level II pricing, and rapid order execution. It's particularly popular among scalpers and day traders.

TradingView is best for traders who prioritise charting and social trading features. Its extensive range of technical analysis tools and vibrant community makes it ideal for those who base their trading strategies on technical analysis and community insights.

Pepperstone's proprietary platform is tailored for traders who prefer a streamlined, intuitive interface with quick access to essential trading functions and market analysis. It's perfect for traders who value efficiency and ease of use in their trading experience.

These platforms are available as desktop and web-based platforms and mobile apps for Android and iOS devices, ensuring traders can access the markets anytime, anywhere. The mobile apps are designed to provide a seamless trading experience, mirroring the functionality and tools available on the desktop versions.

Proprietary Trading App

When researching mobile trading platforms, Pepperstone's new offering has caught my attention for its straightforward approach. This platform aligns well with forex traders looking for a combination of convenience and essential functionality. The platform facilitates CFD trading across various assets, including forex, commodities, indices, and cryptocurrencies, making it versatile for different trading interests.

One of the aspects I appreciate about this app is its Quick Switch feature, which allows seamless swapping between charts - a handy tool for fast-paced trading. The ability to view and amend positions and trading on live-streaming prices adds to its practicality. The app also includes multiple charting options and analysis tools, providing comprehensive insights into market movements. The platform integrates technical indicators and risk management features, which helps in making informed trading decisions.

Justin Grossbard of CompareForexBrokers.com sums it up well, noting, "Pepperstone's new trading platform efficiently addresses the essentials of mobile trading. Its straightforward design and essential trading tools cater well to traders who value simplicity and core functionality in their mobile trading experience." In my experience, this platform is particularly suited for traders prioritising ease of use and essential trading tools in a mobile trading environment.

Trading conditions

Pepperstone's trading conditions have been a key factor in its reputation as a leading forex broker. When assessing the trading conditions of over 20 leading brokers, I found Pepperstone's execution speeds among the most competitive globally.

During testing, Pepperstone's execution speeds were a swift 77ms for limit orders and 100ms for market orders. This performance surpasses the industry average by 28 per cent to 39 per cent, a significant margin that can impact trading outcomes. Comparing these speeds to a major broker like IG Group, Pepperstone's limit order execution is faster by 56 per cent, a major benefit if you value quick and efficient trade execution.

This efficiency stems from Pepperstone's strategic use of top-tier liquidity providers and their Equinix server locations in New York and London. These factors contribute to a trading environment that offers both reliability and efficiency, which, in my experience, are key to successful trading.

Trading accounts

Pepperstone offers two primary account types, each requiring no initial minimum deposit to open. The Standard account offers a more straightforward approach with no commission fees and spreads starting from 1.0 pip. This account type is well-suited for beginners or those who prefer a simpler, more predictable cost structure. The absence of commission fees makes it easier for new traders to understand their trading costs upfront.

On the other hand, the Razor account, with its ECN-like spreads and a commission of AU $7 round turn (per 100k lot), is particularly appealing to experienced traders who seek tight spreads and a more transparent fee structure. Suppose you are a scalper or high-volume trader. In that case, you will enjoy the benefit of lower trading costs associated with tighter spreads.

In evaluating over 40 brokers for the lowest spreads, Pepperstone's Razor account emerged as a standout, especially for EUR/USD and AUD/USD pairs. Their EUR/USD spread averages just 0.1 pips, a 55 per cent reduction from the industry average of 0.22 pips. For AUD/USD, Pepperstone offers a spread of 0.3 pips, 35 per cent lower than the industry average of 0.46 pips

Customer support

Pepperstone is renowned for its award-winning customer service, which is particularly advantageous for Australian traders. Their support system includes various contact methods such as live chat, email, and phone support, ensuring accessibility and convenience. The support hours are tailored to Australian traders, providing timely assistance during local trading hours. This local focus means Australian traders can expect quicker and more relevant responses to any queries you may have.

Why I like Pepperstone

I've been really impressed by the new Pepperstone app. While the CFD broker offers a range of platforms, their proprietary app really stands out for its ease of use. Their fast execution speeds and two main account types - the beginner-friendly Standard and the more advanced Razor - cater to all trading styles. Plus, their customer support is especially good for Australian traders, offering timely and relevant assistance.

3. OANDA - Best Forex Broker for Low Spreads

OANDA, a US-based broker established in 1996, stands out for its low spreads that can be as low as 0.6 pips on EUR/USD. In my experience using their mobile apps, including OANDA Trade, MetaTrader 4, and TradingView, I've found them efficient and user-friendly, aligning well with the needs of active traders.

This blend of competitive spreads and functional trading apps makes OANDA a top choice if you prioritise cost efficiency and the flexibility of trading on the go.

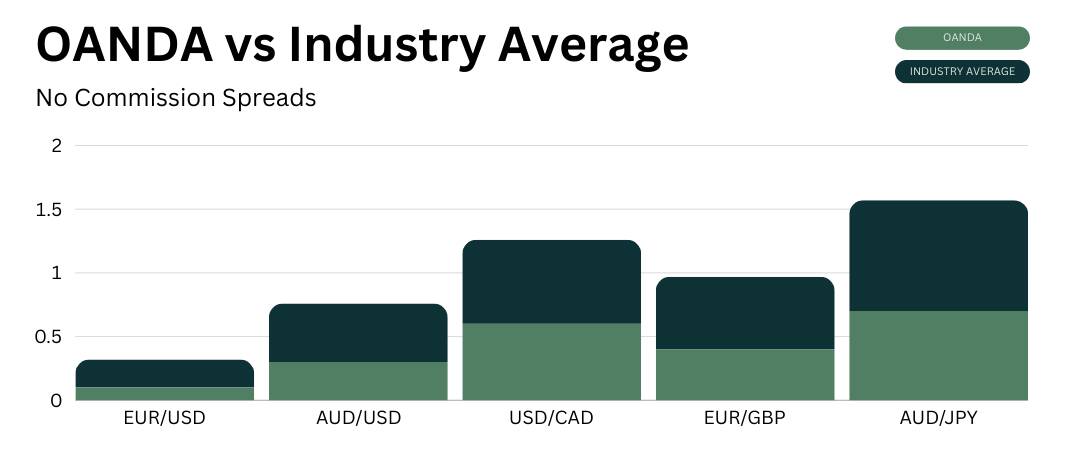

No Commission spreads

In my comparison of forex brokers, OANDA's standard spreads are impressively competitive, closely rivalled only by IC Markets. For major pairs like EUR/USD, OANDA offers a spread of 0.6 pips, significantly lower than the industry average of 1.24 pips, marking a reduction of about 52%.

Similarly, their AUD/USD spread at 0.7 pips is around 55 per cent lower than the industry average of 1.54 pips.

While IC Markets occasionally offers slightly tighter spreads - by a mere sliver in some cases - OANDA and IC Markets are generally neck and neck across most pairs. For instance, IC Markets' spread for EUR/USD is 0.62 pips, just a touch above OANDA's 0.6 pips.

This close competition underscores both brokers' commitment to providing cost-effective trading options, with OANDA maintaining a slight edge in several key currency pairs.

Trading Platforms

OANDA's mobile trading platforms provide traders the flexibility and tools for on-the-go trading. Here's a closer look at each mobile platform option:

1. OANDA Trade Mobile App:

Customisable Interface: Tailor the app to your trading preferences, including setting up default trading parameters.

Advanced Charting: Access a suite of chart types, overlays, indicators, and drawing tools for comprehensive market analysis.

Market News and Data: Stay informed with up-to-the-minute news and market analyst commentary.

Alerts and Analytics: Set alerts for market movements and utilise trader performance analytics to refine strategies.

Device Compatibility: Available for iOS and Android, ensuring a wide range of device support.

2. MetaTrader 4 Mobile App:

Automated Trading: Supports expert advisors for automated trading strategies.

Customisable Layouts: Offers a range of plug-ins and an intuitive interface for a personalised trading experience.

Trade from Charts: Direct trading from charts with multiple timeframes and built-in indicators.

MT4 Premium Upgrade: Access additional tools and apps for advanced trading on mobile.

3. TradingView on Mobile:

Community Features: Engage with a global community of over 30 million traders for idea exchange and discussion.

Flexible Alerts: Set custom alerts for various market situations, including price moves and technical indicators.

Strategy Testing: Utilise indicator summaries and backtest trading strategies using TradingView's analytical tools.

Technical Analysis: Offers extensive chart types and indicators, enhancing mobile technical analysis capabilities.

Justin Grossbard from CompareForexBrokers highlights the importance of these platforms, stating, "In today's fast-paced trading environment, the ability to trade effectively from a mobile device is crucial. OANDA's mobile apps, including the versatile OANDA Trade, the community-focused TradingView, and the robust MetaTrader 4, provide you with the necessary tools and flexibility for successful mobile trading."

OANDA's mobile platforms cater to diverse trading needs: OANDA Trade for customisable, detailed market analysis, TradingView for community-driven technical analysis, and MetaTrader 4 for automated trading with EAs.

Why I like OANDA

I've found OANDA to be a great choice for its ultra-low spreads, which can be up to 52 per cent lower than the industry average. Their range of mobile apps, including OANDA Trade, MetaTrader 4, and TradingView, are both efficient and user-friendly, aligning well with the needs of active traders. This blend of competitive spreads and functional trading apps positions OANDA as a top pick if you are focusing on cost efficiency and flexible mobile trading.

4. IC Markets - Best apps for share trading

Originating from Australia, IC Markets has made a significant mark in the online trading industry, particularly forex trading. Broadening its horizons, the Sydney-based broker now offers actual share trading, allowing access to over 2,200 Australian listed companies. This service complements its CFD products, including foreign exchange, global indices, commodities, bonds, and crypto.

The broker offers advanced trading platforms such as MetaTrader 4, MetaTrader 5, and cTrader, making IC Markets a well-rounded choice for traders seeking a wide range of trading opportunities.

Share trading services

While IC Markets is renowned for its forex trading services, its offerings have recently expanded to include actual share trading alongside share CFDs. This new service allows traders to invest in over 2,200 Australian listed companies, providing access to a wide range of equities from small to mid-cap and blue-chip companies.

You can now secure stakes in top-performing ASX-listed shares with the security of a Holder Identification Number (HIN), ensuring investment ownership under their name. This addition complements IC Markets' existing range of over 2,100 stock CFDs across the ASX, NYSE, and NASDAQ, available on the MetaTrader 5 platform.

With this expansion, IC Markets offers traders the flexibility to trade actual shares and share CFDs, enhancing their investment opportunities in the equities market.

Other financial instruments

As well as thousands of stock CFDs, IC Markets offers a comprehensive range of CFD products across various asset classes. The platform's foreign exchange segment includes over 60 currency pairs, providing ample opportunities for forex traders. Additionally, the CFD broker offers access to over 23 global indices, allowing exposure to global equity markets.

Beyond traditional commodities, IC Markets also provides futures, allowing you to explore various markets, including energy, agriculture, and metals. While ETFs are not currently on offer, the broker compensates with its extensive selection of stock CFDs.

IC Markets also caters to those interested in the bond market with bond CFDs. For cryptocurrency enthusiasts, the platform offers trading in 21 popular digital currencies.

Trading apps and accounts

IC Markets excels in mobile trading with its advanced platforms MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, each optimised for mobile use. These platforms cater to various trading styles and are accessible on Android and iOS devices, ensuring traders can manage their portfolios on the go.

MetaTrader 4 (MT4) Mobile App: Renowned for its user-friendly interface, the MT4 app is ideal for forex trading and supports a range of CFDs. It's a favourite among beginners and intermediate traders, including those who use scalping strategies. The app allows algorithmic trading with Expert Advisors and is available for customisation and download.

MetaTrader 5 (MT5) Mobile App: As a multi-asset platform, the MT5 app extends its capabilities to CFD trading and share investments. It supports automated trading and provides access to the MQL5 community. The app's design ensures ultra-fast execution speeds, making it suitable for traders who require quick and efficient trading operations.

cTrader Mobile App: Known for its institutional-grade trading environment, the cTrader app offers a customisable interface and advanced charting options. It's particularly suited for forex trading and algorithmic strategies, providing direct access to liquidity pools and backtesting facilities.

IC Markets' mobile apps offer the flexibility and functionality needed for effective trading in today's fast-paced markets, making it a top choice for traders looking for reliable and versatile mobile trading solutions.

Trading fees

In terms of account types, IC Markets offers three main options:

Standard Account: This account is available on the MT4 or MT5 and is designed for beginner forex traders. It features zero commissions on trades with larger spreads.

Raw Spread Account: Available on the MT4 or MT5. Offers low spreads for true ECN brokers, starting from 0 pips for EUR/USD, plus a commission of $3.50 per lot. It's ideal for traders looking to create Expert Advisors or day trading strategies.

cTrader Raw Account: This account offers low ECN broker spreads plus a commission of $3.00 per lot and is available on the cTrader platform. It provides an institutional-grade trading environment and is suitable for traders who prefer the cTrader platform's features.

IC Markets overall

I've found IC Markets to be a standout choice for their extensive share trading options, giving access to a wide range of Australian shares. Their selection of platforms, like MetaTrader 4, MetaTrader 5, and cTrader, suits varied trading needs, and their mobile apps make trading on the go a breeze. Lastly, their competitive spreads with both ECN and commission-free pricing offer great value

5. FP Markets - Top Broker for MetaTrader 4

In my dealings with FP Markets, I've been impressed by their adept use of MetaTrader 4. This Australian broker has tailored the MT4 platform to offer a user-friendly yet comprehensive trading experience. It's particularly appealing for its integration of advanced tools and features, including valuable add-ons like Autochartist and Myfxbook.

These enhancements, coupled with FP Markets' low trading fees, make it a standout choice if you are seeking a sophisticated yet accessible trading environment.

Forex Trading Apps

When trading with FP Markets, you can choose between MetaTrader 4 (MT4), MetaTrader 5 (MT5), and Iress. These apps are available for Android and iOS devices, allowing traders to manage their trades on the go. These platforms' mobile versions maintain their desktop counterparts' core functionalities, ensuring a seamless trading experience.

MT4 Analysis and Research Tools

FP Markets' MetaTrader 4 platform is equipped with a range of tools and features that enhance the trading experience:

Customisable Interface: Traders can tailor the MT4 interface, including the colours of technical indicators, to suit their preferences.

One-Click Trading: This feature streamlines the trading process, allowing for quick and efficient trade execution directly from the charts.

MarketWatch and Live Price Streaming: Real-time price streaming on live and demo accounts ensures traders have up-to-date market information.

Expert Advisors (EAs): MT4 supports automated trading with EAs, enabling traders to implement strategies without manual intervention.

Customisable Alerts: Traders can set up alerts for market movements and indicators.

Access to MetaTrader Market and MQL4 Community: This provides a wealth of resources for traders, including additional tools and community support.

In terms of mobile compatibility, the MT4 app for iOS and Android retains these key features, ensuring traders can access comprehensive trading tools and real-time data while on the move.

FP Markets also integrates additional tools with MT4:

Autochartist: This tool offers automated market analysis, identifying trading opportunities based on technical patterns.

Myfxbook: A social trading service that allows traders to follow and copy the strategies of successful forex traders.

Traders Toolbox: An exclusive suite of advanced trading tools provided by FP Markets, offering sophisticated trade execution management, decision assistance, alarms, real-time news, and market data apps, all accessible within the MT4 platform.

These add-ons enhance the MT4 platform's capabilities, providing traders with advanced analysis and social trading options.

Account Types

FP Markets offers tailored account types for different traders. The Standard Account, ideal for beginners, is available on MT4 and MT5 platforms with no commission on trades.

For more experienced traders, the Raw Account on both platforms offers low spreads from 0 pips for EUR/USD and a commission of AU $3.50 per lot, suitable for day trading or Expert Advisor strategies.

FP Markets also provides a Professional Trader account with higher leverage for seasoned traders who meet specific criteria, allowing for larger trading positions.

Why I like FP Markets

In my experience, FP Markets stands out for their enhanced MetaTrader 4 platform, integrating tools like Autochartist and Myfxbook. This, along with their low trading fees and a range of forex trading apps for Android and iOS, makes them a strong choice. They offer tailored account types, including Standard and Raw Accounts, catering to both beginners and experienced traders.

6. IG Trading - Largest Broker for CFD Trading

As the world's largest CFD brokerage for retail investors, IG Trading offers an impressive range of products. With over 17,000 markets, you gain access to an unparalleled selection of CFD trading options across various asset classes as an IG client. This extensive offering, combined with IG's strong trust and reputation in the industry, makes it a top choice if you are seeking both variety and reliability in your trading endeavours.

CFD product range

IG Trading offers an extensive range of over 17,000 markets for CFD trading. This includes opportunities in forex with over 60 currency pairs, more than 23 global indices, and a wide selection of shares.

Traders can also trade both hard and soft commodities. For those interested in the digital currency market, IG provides options to trade in major cryptocurrencies like Bitcoin and Ether.

Additionally, the broker offers specialised markets such as bonds, rates, and options. However, it's important to note that trading in ETFs is not currently available with IG.

Trust and reputation

Established in 1974, IG Trading has firmly positioned itself as a leader in the online trading industry, serving over 320,000 clients globally. Recognised for its unwavering commitment to trader success, this broker also adheres to strict regulatory standards.

IG Trading is overseen by the Australian Securities and Investment Commission (ASIC), as well as other major financial services regulators like the UK's Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC).

IG Trading's high Trustpilot score of 4 out of 5 stars reflects the broker's dedication to providing a secure and trustworthy trading environment. The broker has also been recognised with numerous awards for its mobile apps and innovation.

Trading apps

IG Trading's trading platforms cater to multiple trading styles and preferences. The broker offers a proprietary online platform, complemented by award-winning mobile apps for both Android and iOS devices. These apps ensure traders can manage their portfolios on the go without missing out on any opportunities.

IG Trading also provides access to popular third-party platforms like MetaTrader 4 and ProRealTime, each offering unique features and tools for a tailored trading experience. The platforms are known for their fast execution speeds, user-friendly interfaces, and comprehensive analysis capabilities.

IG Overall

IG Trading really stands out as the world's largest CFD brokerage, offering an impressive range of over 17,000 markets. This includes everything from forex and global indices to cryptocurrencies, providing a wealth of trading options. Additionally, their advanced trading platforms, including user-friendly mobile apps and access to third-party platforms like MetaTrader 4, make trading accessible and efficient. For anyone looking for variety and reliability in their trading endeavours, IG Trading is a solid choice.

7. Plus500 - Best Demo Trading Account for beginners

Founded in 2008 in Israel, Plus500 quickly established itself as a user-friendly platform ideal for beginners. Known for its straightforward approach, the broker offers an excellent demo account and strong risk management tools, making it a top choice for those new to trading.

Demo Account

Plus500's demo account is a standout feature, especially for beginners. It serves as an excellent educational tool, allowing you to familiarise yourself with trading dynamics without the need to fund a live account or take on the high risk of losing real money.

With a virtual trading balance of US $50,000, the demo account mirrors the real trading environment, providing a safe space for practice and strategy development. This feature is particularly beneficial as it eliminates concerns about inactivity fees, which can be a deterrent for those just starting out.

User-friendly mobile app

Plus500's proprietary mobile app is designed with user-friendliness in mind, making it ideal for beginners. The app, available for Android and iOS devices, offers a streamlined trading experience. It maintains the core functionalities of the Plus500 desktop platform, ensuring traders can manage their portfolios effectively while on the go.

The mobile app's intuitive interface allows for easy navigation and quick access to essential trading functions, making it a convenient choice for those new to trading.

Risk management

Risk management is a crucial aspect of trading, and Plus500 addresses this with features like Guaranteed Stop Loss Orders (GSLOs). GSLOs are an excellent tool for beginners to manage risk, as they cap the maximum loss from a trade at a predetermined amount. This feature provides peace of mind and control over potential losses, essential for those still learning the ropes of trading.

Noam Korbl, an industry expert from CompareForexBrokers, emphasises the importance of GSLOs, stating, "Guaranteed Stop Loss Orders are a great way for beginners to manage risk. They provide a safety net, ensuring you don't lose more than they can afford, which is vital in the volatile trading world."

Why I Like Plus500

Plus500 is an excellent choice for beginners, offering a user-friendly platform with a demo account featuring a $50,000 virtual balance. Their mobile app, available on both Android and iOS, is intuitive and easy to navigate, making it ideal if you are a new trader. Additionally, Plus500's focus on risk management, particularly with features like Guaranteed Stop Loss Orders, provides a controlled environment if you are just starting out forex trading.

8. eToro - Popular copy trading app

eToro, established in 2007 in Israel, has become a trailblazer in online trading with its innovative copy trading services. The CFD broker stands out for enabling users to effortlessly copy the strategies of seasoned traders, making it a favourite among those new to trading or looking to diversify their strategies.

Copy trading

eToro's copy trading system allows you to find and replicate the strategies of successful traders, making it a popular choice for those looking to leverage the expertise of others. With access in over 140 countries and millions of users, the CFD bro provides a diverse range of traders to copy, which can be filtered by factors like location and risk score.

The CopyTrader feature lets you directly copy the trades of individual traders, while CopyPortfolio groups together several traders or assets under a predetermined market strategy. This approach allows for diversification and the potential to spread risk across various instruments. Top traders on eToro are incentivised to share their strategies by receiving payouts based on the number of followers they accumulate.

Mobile app

The eToro mobile app, available on iOS and Android, offers a comprehensive on-the-go trading experience. It supports trading in CFD stocks, indices, ETFs, forex, and commodities, as well as social trading features like a live newsfeed. Traders can also post updates and share or comment on others' posts, creating a tailored feed that filters out irrelevant information. The platform also provides notifications for important updates or increased volatility in monitored CFD assets.

Why I like eToro

I find eToro quite impressive for its innovative copy trading services. It's ideal for beginners or those looking to diversify their trading strategies, thanks to its easy-to-use system that allows copying seasoned traders' strategies. The mobile app, available on both iOS and Android, is great for on-the-go trading and includes useful social trading features.

Who is the best forex broker in Australia?

In Australia, Eightcap, Pepperstone, and OANDA consistently stand out. These brokers excel in offering advanced mobile trading platforms, competitive spreads, and a range of trading tools.

Eightcap is renowned for its user-friendly interfaces and efficient trading solutions. At the same time, traders favour Pepperstone for its superior technology and low-cost spreads. OANDA, known for its competitive pricing, particularly on major currency pairs, offers a blend of cost efficiency and versatile mobile trading options.

Collectively, these brokers provide a comprehensive trading experience, combining technological innovation, market accessibility, and user-centric features, making them the best choices for forex traders in Australia.

How to verify regulated brokers in Australia

To understand whether an Australian broker is regulated, you'll need to check its registration with the Australian Securities and Investments Commission. ASIC maintains an online register where you can find information on financial services organisations, including forex brokers.

When checking a broker, look for their Australian Financial Services (AFS) license number. Holding a valid ASFL ensures that the broker is authorised to offer financial services, including derivatives trading, in Australia. To verify this, visit the professional register database on ASIC's website. Enter the broker's name or AFSL number in the search bar. A regulated broker will have their details listed, including the financial services they are authorised to provide.

This step is crucial for ensuring that you're dealing with a legitimate and regulated entity, providing an added layer of security and compliance with Australian financial regulations. Remember, trading with a regulated broker is vital for safeguarding your investments and avoiding scams.

What is the best forex trading platform in Australia?

In Australia, the most popular forex trading platforms are MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are widely recognised for their advanced trading features, user-friendly interfaces, and extensive customisation options. MT4, known for its sophisticated charting and analytical tools, is particularly favoured by forex traders. MT5, while building on the strengths of MT4, offers additional capabilities for trading a broader range of financial instruments.

Top Australian brokers like Eightcap, Pepperstone, and IC Markets offer these platforms, highlighting their reliability and industry-wide acceptance. These brokers provide a seamless trading experience on MT4 and MT5, with access to a wide range of markets, advanced tools, and efficient execution.

Can I do forex trading in Australia?

Yes. Forex trading is legal in Australia and regulated by the Australian Securities and Investment Commission. ASIC-regulated brokers are required to comply with strict financial standards, including capital adequacy and audit requirements. This regulation ensures that the forex trading environment in Australia is transparent, fair, and in line with international best practices.

Traders can confidently engage in forex trading through these regulated brokers, knowing stringent regulatory measures protect them. This legal framework makes Australia an attractive and secure destination for domestic and international forex traders.

What time is the best time to trade forex?

The best time to trade forex depends on the currency pairs you are trading and market volatility. Generally, the most active forex trading hours are when the market sessions overlap, particularly the London and New York sessions. This overlap occurs from 8:00 AM to 12:00 PM EST and is known for higher liquidity and more significant price movements.

The Sydney session's opening (at 7:00 AM AEST) also presents opportunities for Australian traders, especially for AUD and NZD currency pairs. However, it's important to consider that news events, economic releases, and other factors outside these peak hours can influence forex markets. Therefore, staying informed about global economic events and understanding the specific characteristics of your currency pairs is crucial for successful forex trading.

Disclaimer: This article is for informational purposes only and should not be considered as financial advice. Always conduct your own research and consult with a financial advisor before making any investment decisions.

Disclaimer: This story may include affiliate links with PropCompanies partners who may be provided with compensation if you click through. ACM advises readers consider their own circumstances and needs. You should verify the nature of any product or service, and consult with the relevant regulators' website before making any decision.